Spotlight on Financial Crime

Explore the trends shaping today's financial landscape and their implications for the year ahead.

Download nowA group of four men have been convicted for leading a global investment fraud and money laundering conspiracy that defrauded victims of over $18 million. Known as The Brittingham Group, the defendants misrepresented their business and made false claims about investment returns, claiming investors would see a 200-300 percent return on investment within 20 to 30 days. The group also forged letters from financial institutions to reassure the victims that their money was safe.

Each defendant has been convicted of conspiracy to commit wire fraud, wire fraud, and conspiracy to commit money laundering and faces a maximum of 20 years in prison on each count.

Founded by defendant John C. Nock in 2013, the Brittingham Group claimed to have a proven investment strategy involving the purchase of guarantees and other financial instruments from banks. According to the indictment, over the course of eight years, Nock and his co-conspirators convinced their victims to pay large sums upfront, under the guise of fees or start-up costs, so they could profit from the underlying instrument.

To obfuscate their conspiracy, Nock and his co-conspirator Brian Brittsan instructed victims to send their funds to bank accounts controlled by other individuals involved in the scheme. Once the conspirators received the money, they transferred it through a complicated network of international bank accounts.

Investment fraud has become the most expensive form of fraud in the US in 2022, according to a report by law office Carlson Law. The paper reveals that a staggering $3.82 billion was stolen in 2022 – a significant increase from the previous year’s $1.6 billion. While the number of investment fraud offenders has decreased in the last five years, the US Sentencing Commission has reported that median losses incurred have increased significantly to over $2,880,000.

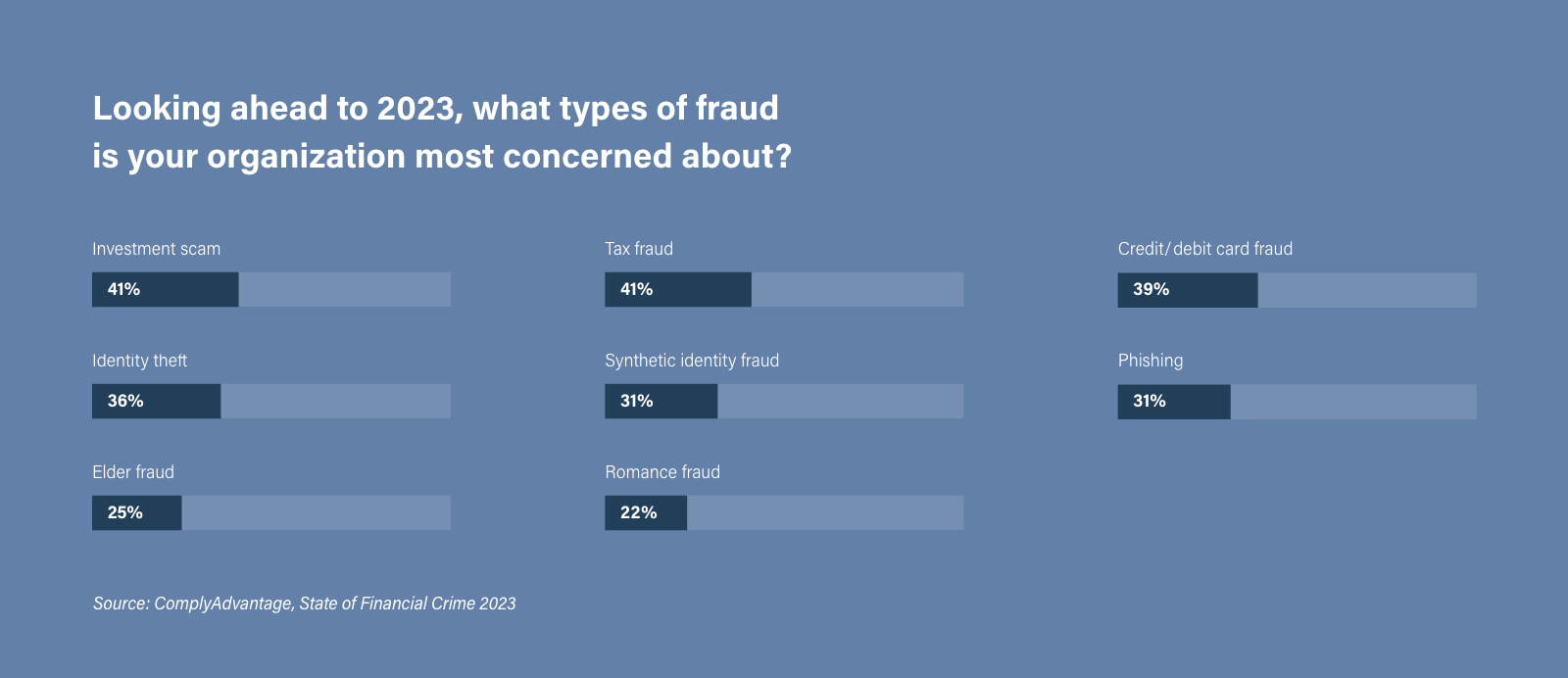

The rise in investment fraud can be attributed to a combination of traditional and modern tactics, with cryptocurrency-related scams being the biggest contributor to this surge. Our 2023 global compliance report echoed this trend, with investment fraud emerging as a top concern for firms worldwide.

Compliance teams can refer to the following steps as a list of best practices to enhance their firm’s fraud risk management programs:

Equipping firms with the right tools to detect and prevent fraudulent activities is crucial in the fight against fraud. The Financial Action Task Force (FATF) has identified artificial intelligence (AI) and machine learning (ML) as effective tools that can help firms detect abnormalities, prioritize alerts, and set fraud transaction monitoring thresholds. Furthermore, forensic and behavioral analytics can be used to connect seemingly unrelated data in a customer’s profile, including across multiple accounts (known as identity clustering).

In the United Kingdom, the 2023 Financial Conduct Authority (FCA) Handbook provides a list of best practices that financial institutions (FIs) should follow when screening for investment fraud. Firms in the US should take note of these tips, which include:

Adjusting transaction monitoring rules for investment fraud typologies based on recommendations from subject matter experts.

Explore the trends shaping today's financial landscape and their implications for the year ahead.

Download nowOriginally published 07 September 2023, updated 18 April 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).