Request a Demo

See how our transaction monitoring and screening solutions can help you reduce false positives.

Request DemoAlviere, an embedded finance platform, helps non-financial institutions provide their customers with integrated financial products. This enables them to offer services including branded cards and bank accounts, global payments, and crypto. As a licensed financial institution also operating through bank sponsorship agreements, its in-house service covers compliance, fraud and risk management, and cutting-edge artificial intelligence-powered security.

Alviere needed a solution to improve operational efficiency and streamline productivity within its compliance department.

With its previous customer screening solution, Alviere also experienced a high volume of false positives, “even for existing customers that had been with us for many years,” explained Chief Compliance & Risk Officer Luis Trujillo.

“ComplyAdvantage, allowed us to transition away from our old model and gave us a new solution that was a lot more efficient and effective for our compliance operations.”

– Luis Trujillo, Chief Compliance & Risk Officer at Alviere

As a result, Alviere partnered with ComplyAdvantage for transaction screening and ongoing monitoring.

Alviere worked with ComplyAdvantage to implement an automated process that immediately screens customers against sanctions, politically exposed persons (PEPs), and adverse media lists. “From there, ComplyAdvantage takes care of monitoring that customer,” says Trujillo.

With these solutions, Alviere also benefits from being able to build new customer profiles within five minutes that fit the financial programs they create for their clients.

“ComplyAdvantage’s KYC screening solution helps us keep our platform clean and ensure we’re only doing business with the people that we want to do business with.”

– Luis Trujillo, Chief Compliance & Risk Officer at Alviere

ComplyAdvantage’s transaction monitoring solution also allowed Alviere to screen larger volumes of transactions than they were previously able to. This enabled Trujillo’s team to ensure any account receiving funds via their international payments products was not sanctioned or deemed high risk.

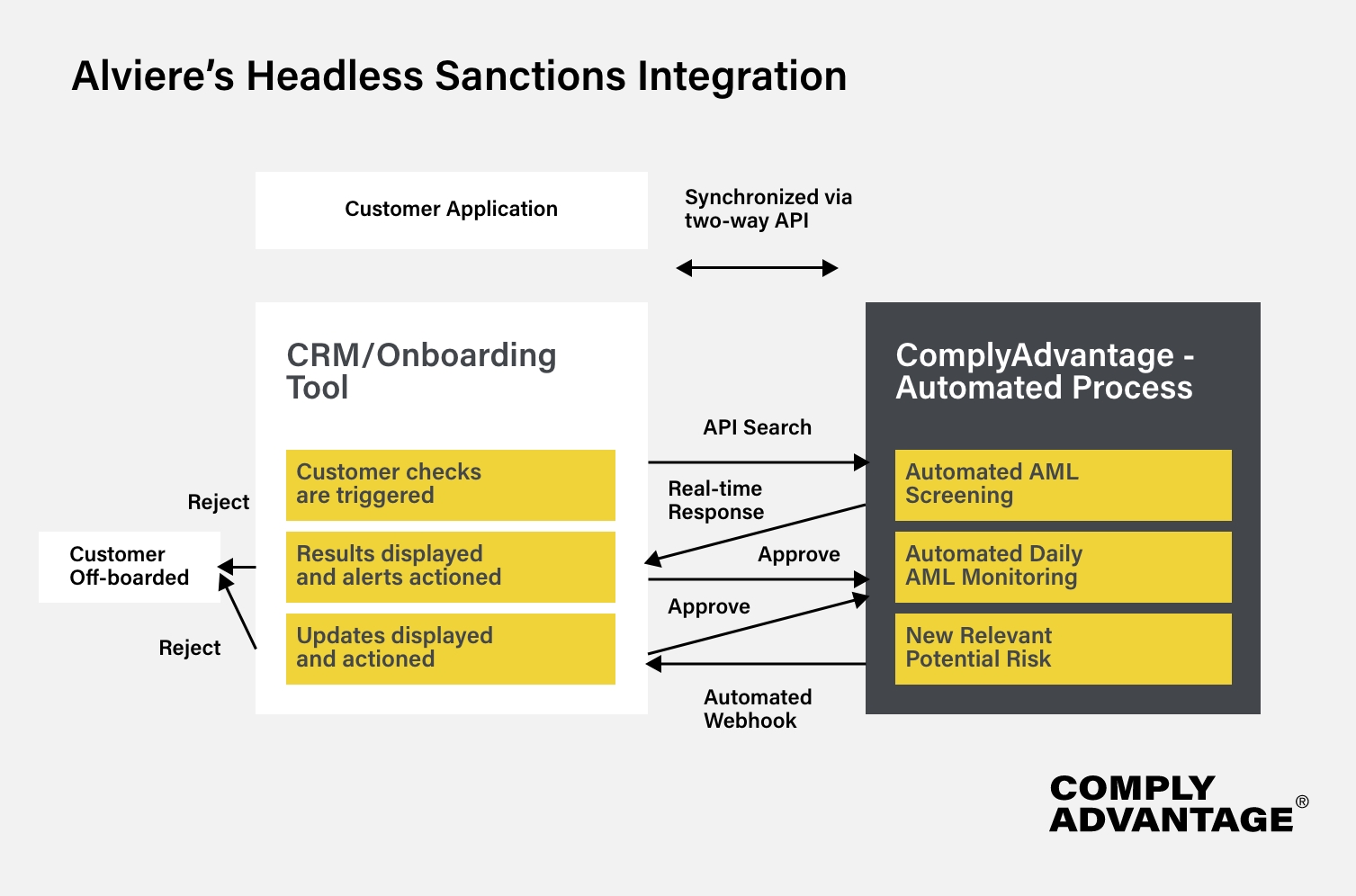

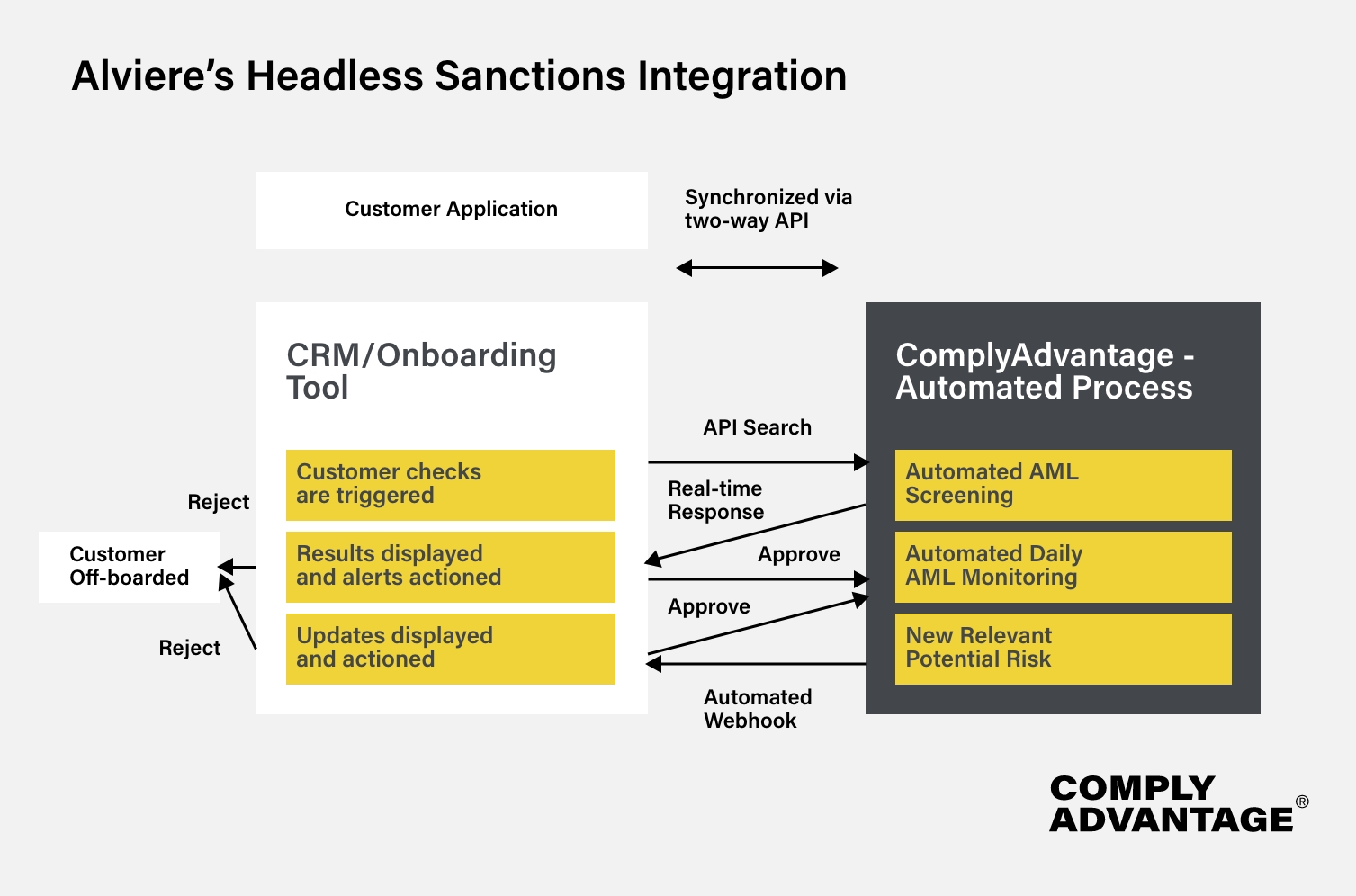

Alviere accesses ComplyAdvantage’s sanctions screening solution via a highly sophisticated headless integration. This allows the two platforms to connect via an API to communicate with one another. In this case, the APIs automatically interface with ComplyAdvantage on the backend, delivering information from ComplyAdvantage to Alviere’s teams and analysts via their in-house portal. This allows them to make crucial decisions without manually contacting ComplyAdvantage’s back office.

Efficiency and productivity are major challenges facing compliance teams. Precious time is lost when analysts switch between multiple systems to gather needed information or wait for responses from external teams or contractors. By using ComplyAdvantage’s RESTful API to create a headless integration, Alviere could address this challenge directly. The integration allows its teams and analysts to benefit from a single, automated source of information and communication within the Alviere platform. This, in turn, streamlines important case and manual review decisions.

Alviere has seen the benefit of its partnership with ComplyAdvantage in the heightened levels of efficiency seen throughout its compliance department.

“Because of ComplyAdvantage’s system, today we are dealing with 48,000 fewer false positives.”

– Luis Trujillo, Chief Compliance & Risk Officer at Alviere

As Alviere’s business expands into European and Mexican markets, “it’s a big help knowing that we have a partner like ComplyAdvantage we can consult with and go to market with on new products and services,” said Trujillo.

See how our transaction monitoring and screening solutions can help you reduce false positives.

Request DemoDisclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).