The State of Financial Crime 2023

Explore the trends shaping today's financial landscape and their implications for the year ahead.

Download nowIn a romance fraud scheme dating back to 2017, the Department of Justice (DOJ) has noted that a Florida resident has pleaded guilty to manipulating an 87-year-old Holocaust survivor into sending her over $2.8 million. After meeting on a dating app, the defendant (Peaches Stergo) defrauded the elderly victim of his life savings, ultimately causing him to lose his Manhattan apartment while she used the proceeds to fund a lavish lifestyle.

Having pled guilty to wire fraud, the defendant is due to be sentenced on July 27, 2023. The maximum sentence for this violation is 20 years in prison. The defendant must also pay $2,830,775 in restitution and forfeit the same amount, along with over 100 luxury items she purchased with fraud proceeds.

The scheme began with Stergo telling the victim she was involved in an injury settlement but could not access her funds due to an outstanding payment to her lawyer. In early 2017, Stergo asked to borrow funds from the victim so she could make the payment that was owed. However, her subsequent promises of repayment never came to light. Over the following years, Stergo continued defrauding the victim, claiming that if he did not send her money, her account would be frozen, and he would never be paid back. In total, the victim wrote 62 checks that were deposited into multiple bank accounts belonging to Stergo.

In addition to perpetrating wire fraud, Stergo also falsified documents and created fake email addresses to convince the victim of her story. The scheme only came to an end when the victim’s son discovered the extent of the damage.

The Federal Bureau of Investigation’s most recent Internet Crime Report highlighted the top cybercrime types faced by US networks, alongside the bureau’s efforts to combat rising threats. According to the report, in 2022, the Internet Crime Complaint Center (IC3) received over 19,000 complaints about “confidence/romance scams,” with reported losses of nearly $740 million.

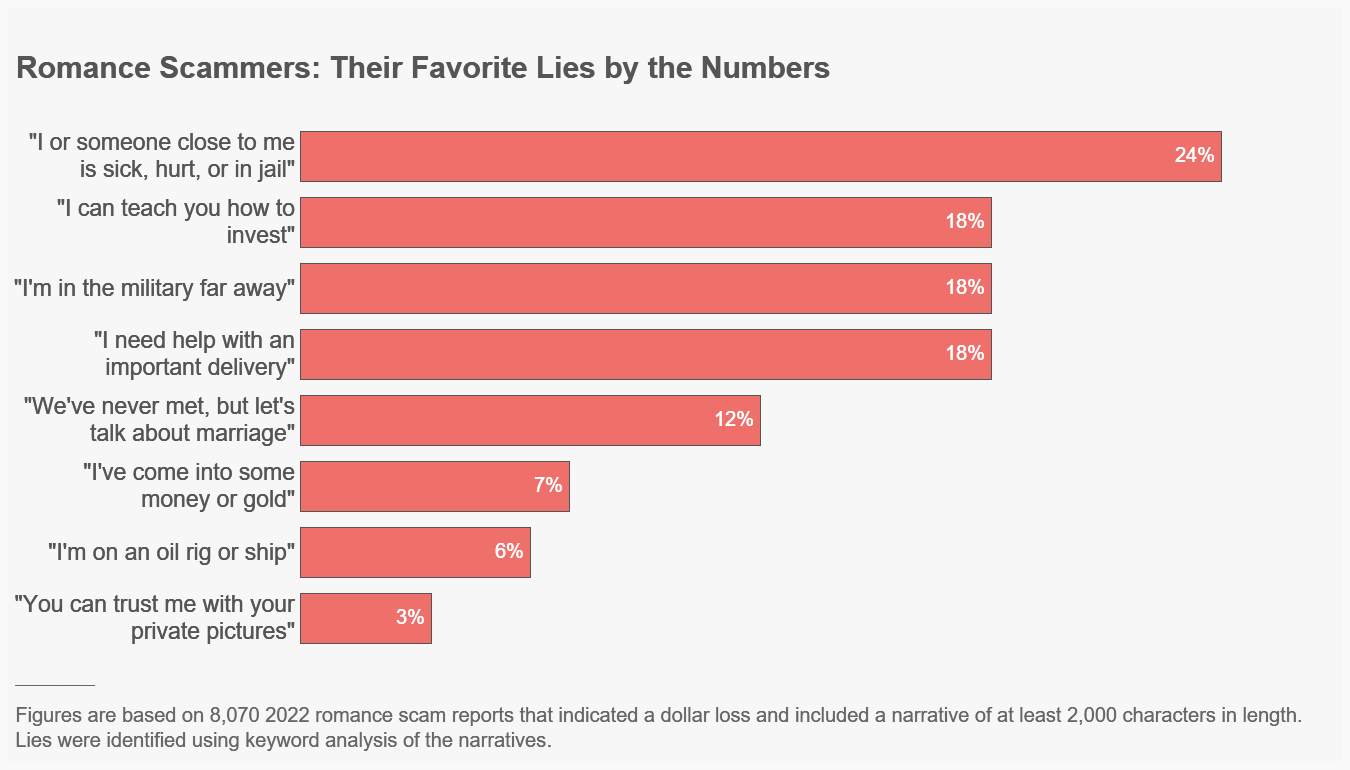

Regarding the tactics fraudsters use to perpetrate this crime type, 2022 data from the Federal Trade Commission (FTC) revealed some of the most common lies told to victims. Compliance teams should ensure they are familiar with these trends, calibrating their transaction monitoring rules to detect instances where transaction notes from the sender may record words or phrases related to the topics below.

Source: The Federal Trade Commission

On a webpage devoted to ‘elder fraud,’ the FBI warns that millions of elderly Americans fall victim to financial fraud every year, with annual losses reaching $3 billion. For compliance staff, vigilance on the ground through frontline staff dealing face-to-face with customers has often been vital to spotting unusual activity on accounts and triggering further investigation. Training these staff on what they should be looking out for is crucial.

However, as more financial services are delivered online, AI-powered anti-money laundering (AML) tools will likely detect more fraud cases. This means compliance teams should ensure they calibrate their transaction monitoring solutions by customer type to help spot elder fraud. The use of adverse media categorization as a know-your-customer (KYC) tool is also important, ensuring risk profiles are continuously updated. Adverse media checks can also help ensure firms are not inadvertently onboarding a new customer who has committed elder fraud in another jurisdiction.

The Financial Crimes Enforcement Network (FinCEN) has also compiled a list of red flags that might indicate elder fraud, including sudden changes in banking behavior, changes in an older person’s signature, and non-payment of bills. When filing a suspicious activity report (SAR) related to potential elder fraud, FinCEN requests that firms use the term “EFE FIN-2022-A002” in SAR field 2 (“Filing Institution Note to FinCEN”) and mark the check box for elder financial exploitation.

Explore the trends shaping today's financial landscape and their implications for the year ahead.

Download nowOriginally published 20 April 2023, updated 18 April 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).