A Guide to AML/CFT Reforms in the US Real Estate Sector

Learn how real estate businesses can respond to US authorities' new measures for improved corporate transparency and financial crime risk management.

Download Your CopyMultiple types of fraud have a nexus with the real estate sector, but most involve a combination of impersonation and the use of false information. With economic volatility and geopolitical uncertainty fuelling a rise in financial crime, real estate fraud has likewise increased in recent years. In 2021, the Boston division of the Federal Bureau of Investigation (FBI) found that over 11,000 individuals nationwide reported average losses of $350,328,166 due to real estate scams – representing a 64 percent increase from 2020.

The Financial Action Task Force (FATF) and US regulators stress that the starting point for all firms is to understand the financial crime risks facing their business and to respond appropriately. Chapter two of our Guide to AML/CFT Reforms in the US Real Estate Sector explores common industry risks. While criminal typologies evolve over time, this blog considers a range of fraud typologies that real estate businesses need to be aware of.

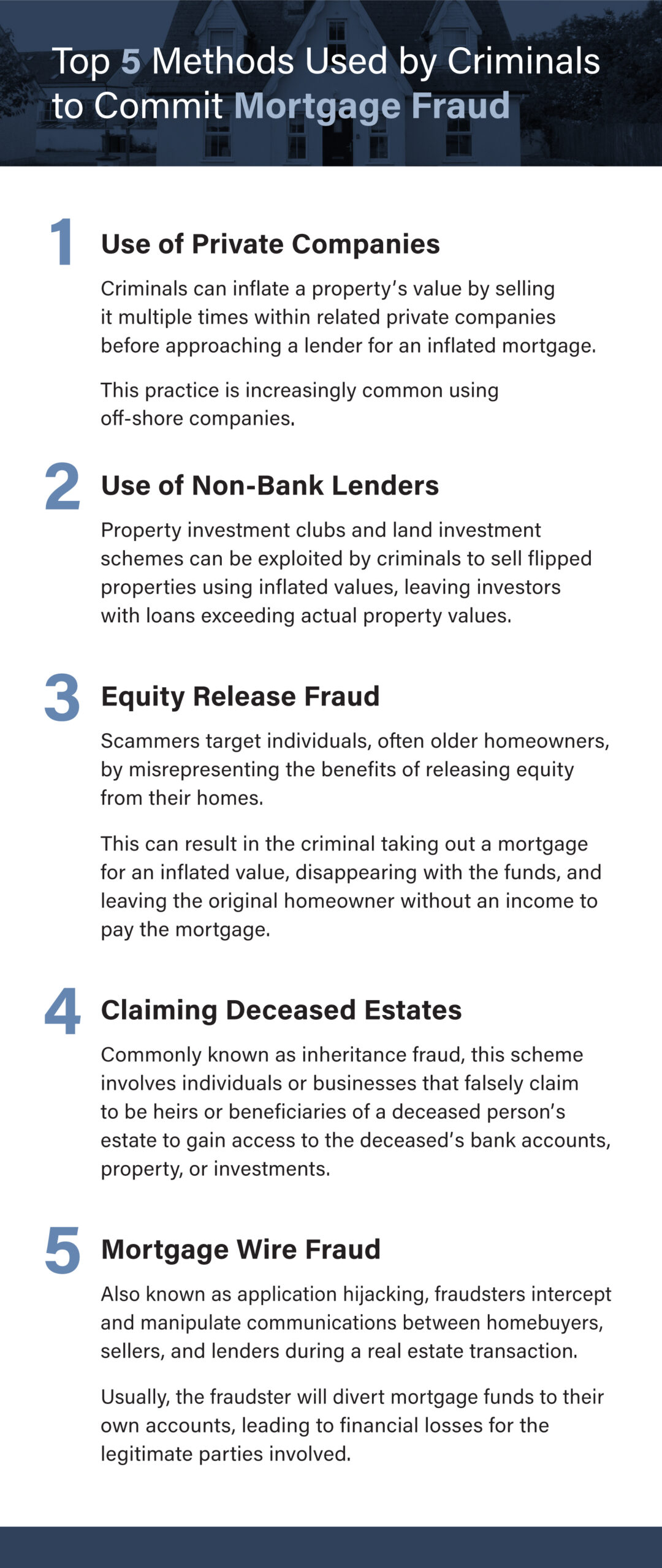

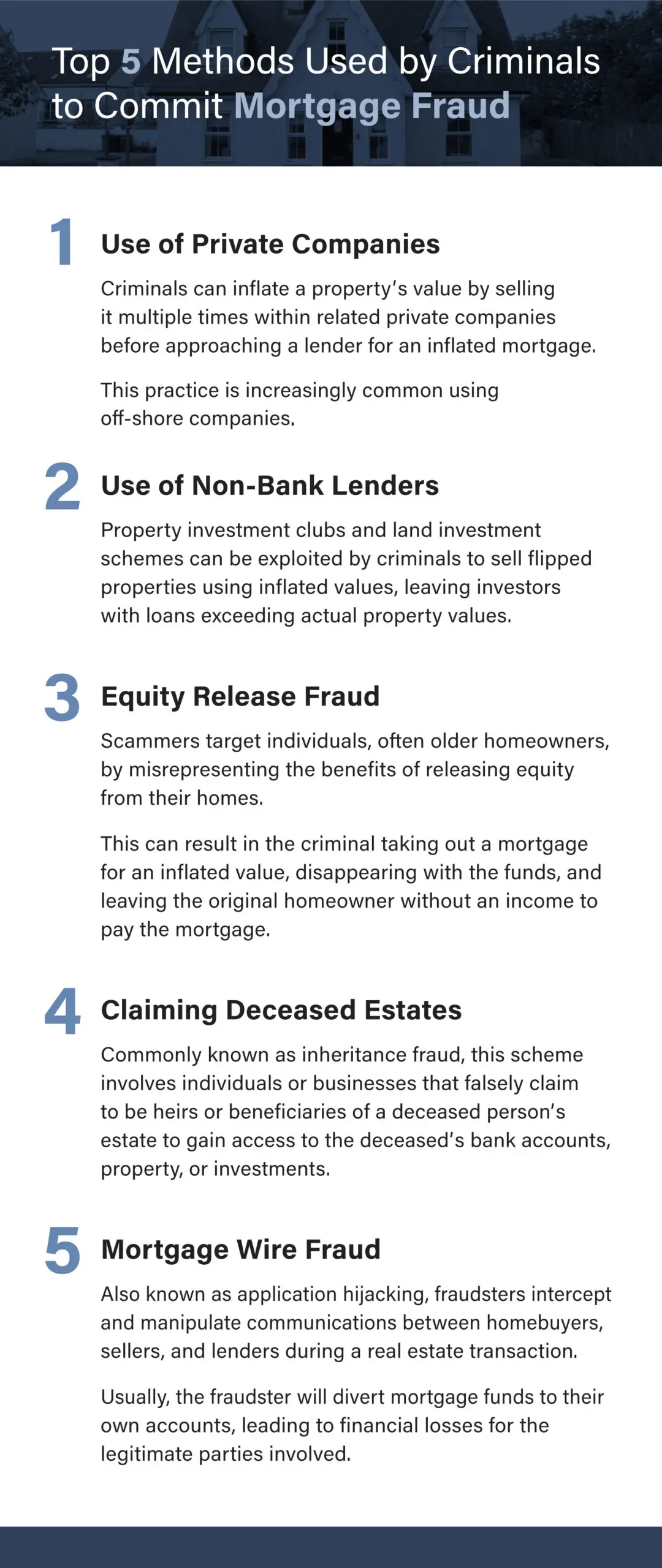

Mortgage fraud is a white-collar crime involving deception or misrepresentation during the mortgage lending process. It typically occurs when individuals or entities, such as borrowers, mortgage brokers, appraisers, or even lenders, intentionally provide false or misleading information to obtain a mortgage loan or to influence the terms of a loan.

Mortgage fraud can take several forms, five of which are highlighted in the graphic below.

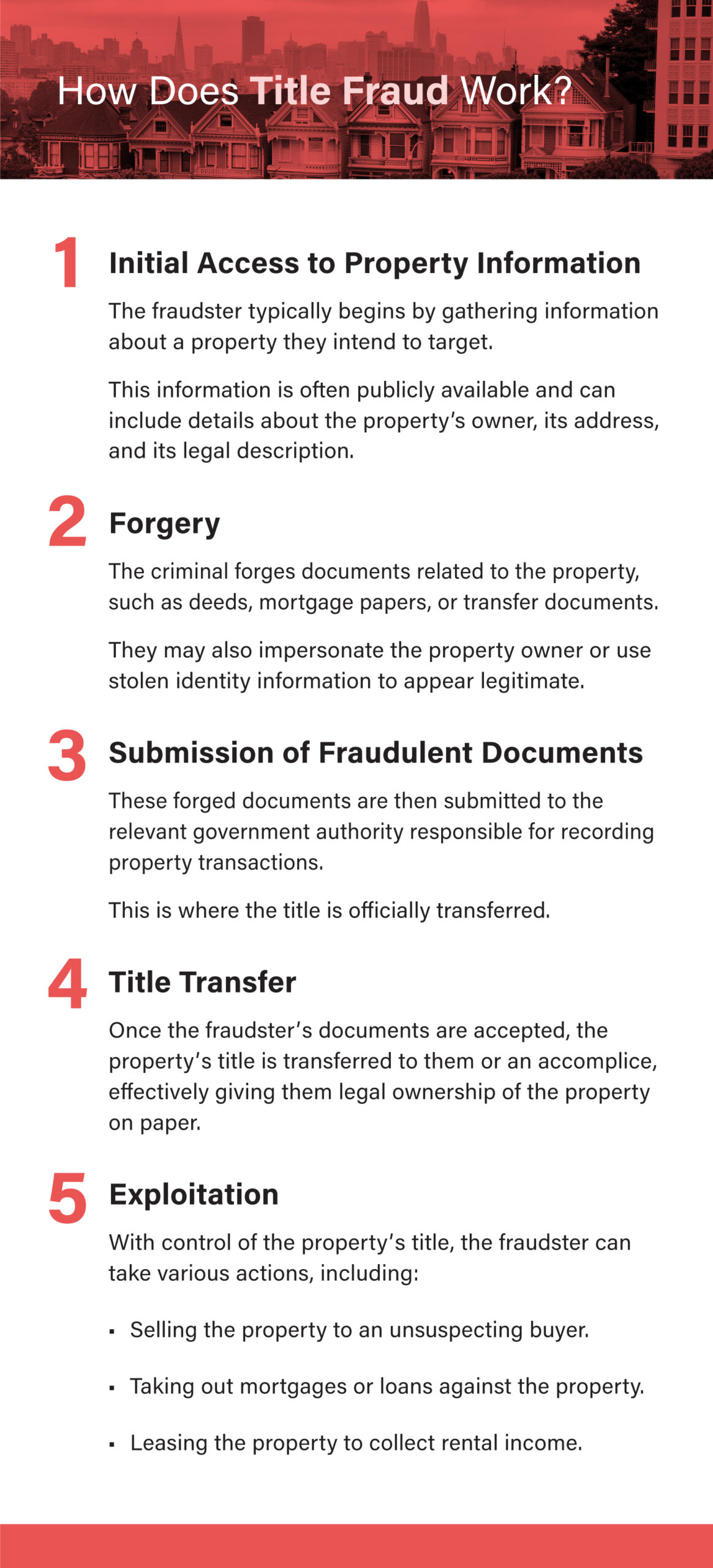

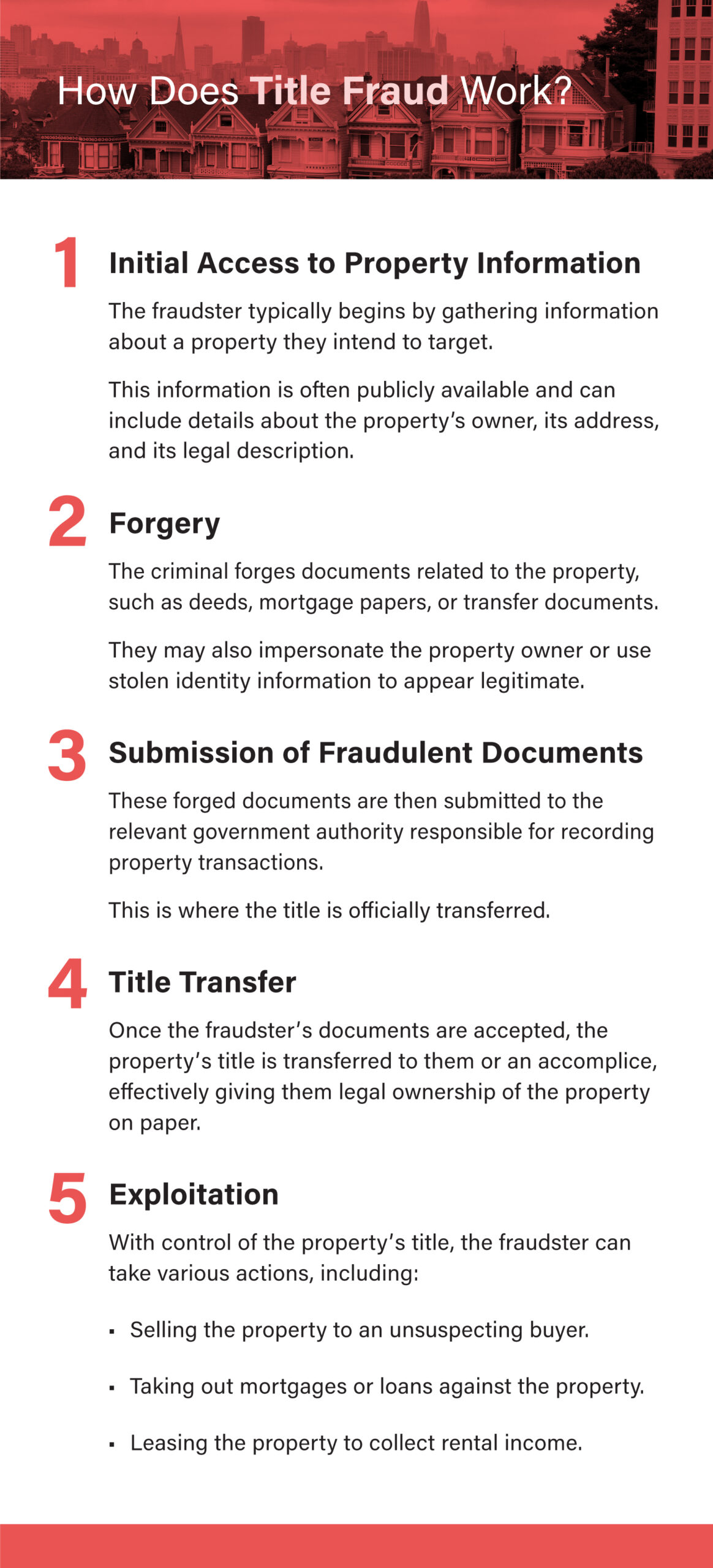

Also known as deed fraud, title fraud is a type of real estate scam where a fraudster illegally transfers the ownership or title of a property to themselves or another party without the knowledge or consent of the legitimate property owners. According to the Financial Crimes Enforcement Network (FinCEN), this type of scam has become particularly rife in the Greater Toronto Area, where at least 30 homes have been fraudulently sold since late 2021.

There are five steps typically involved in title fraud that are highlighted in the graphic below.

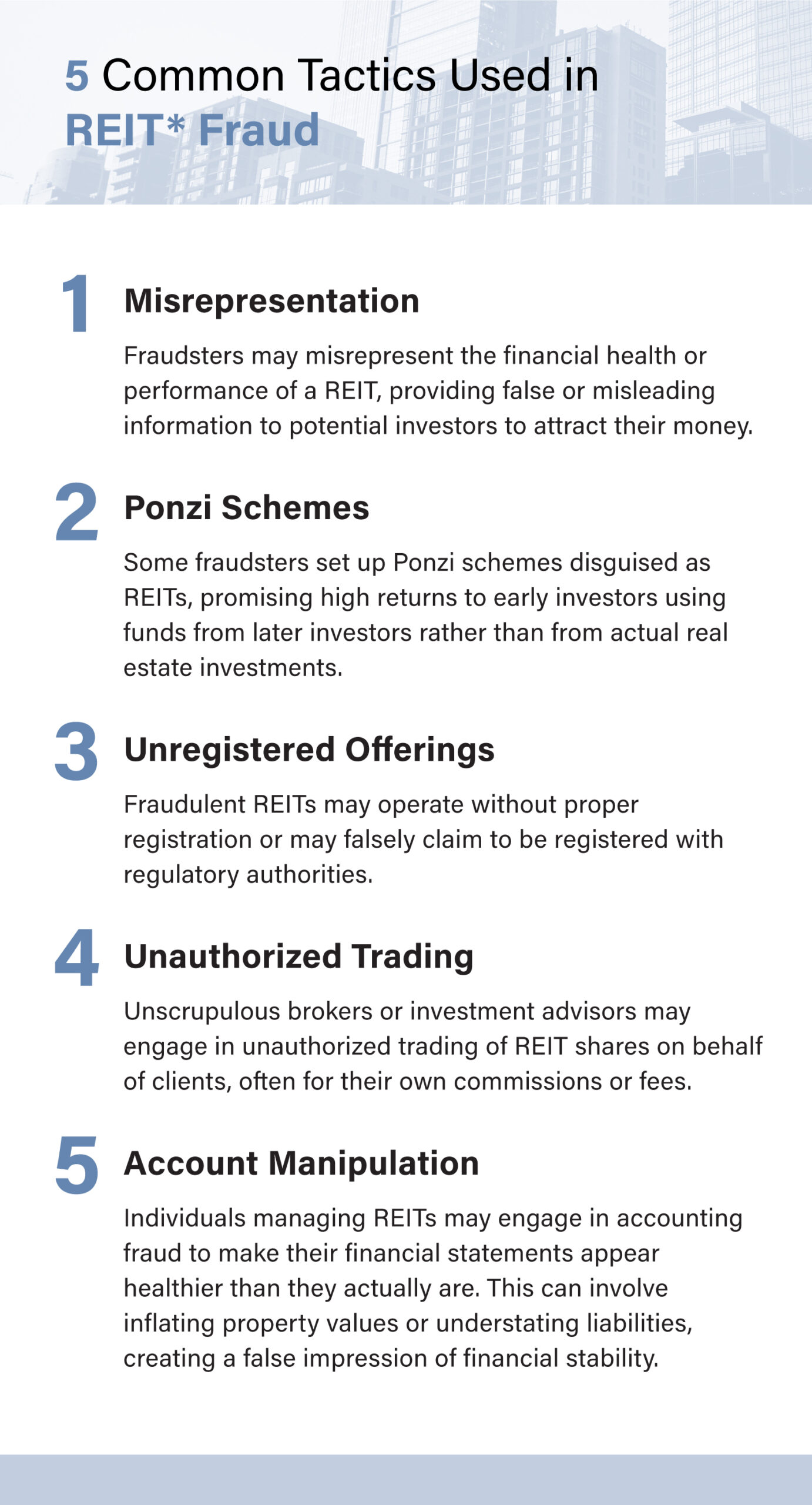

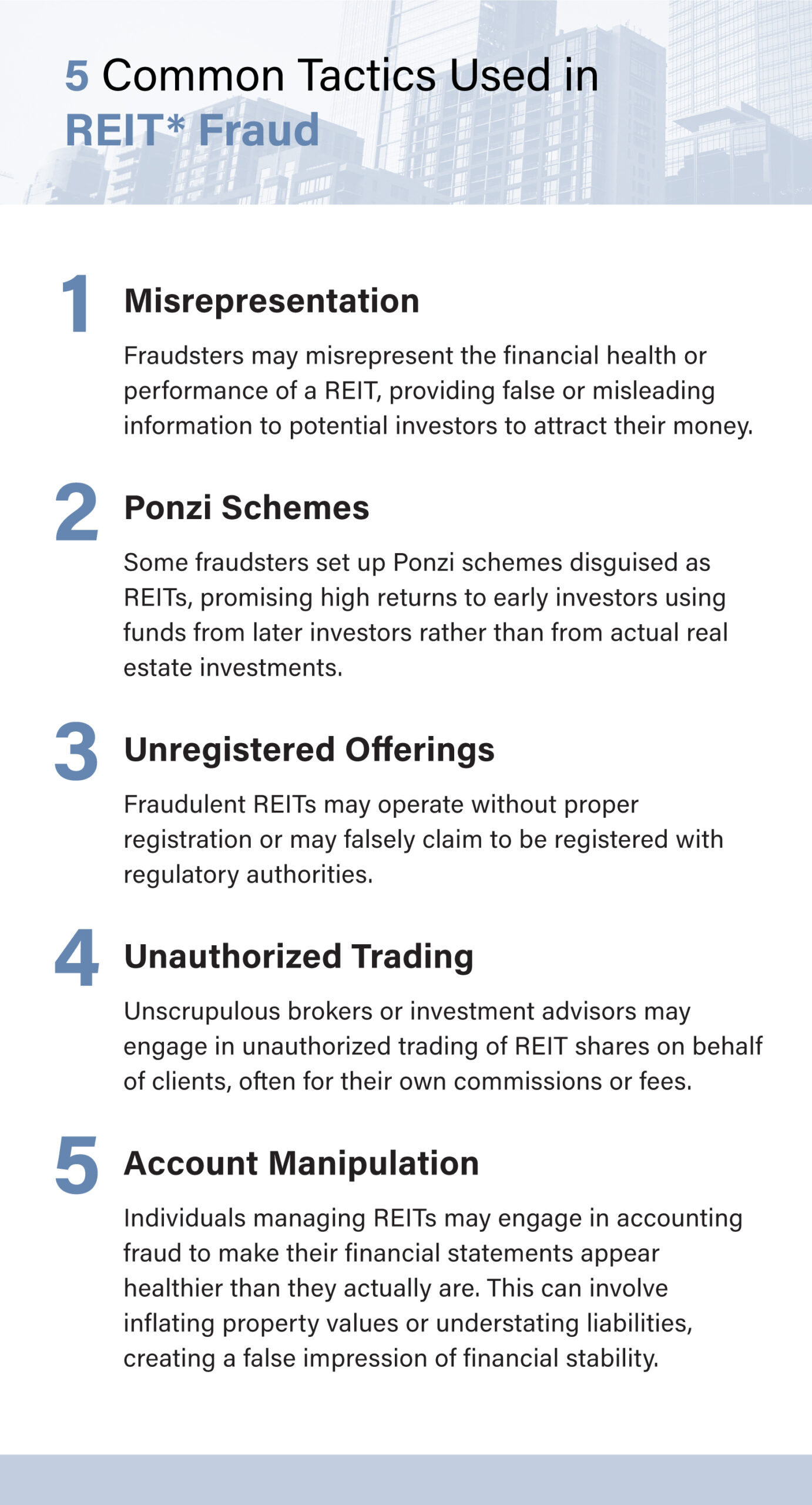

Real estate investment trusts (REITs) are investment vehicles that allow individuals to invest in real estate without owning the physical properties themselves. These trusts own, operate, or finance income-producing real estate, such as apartment buildings, hotels, shopping centers, or office buildings. REITs are subject to specific regulations and offer certain tax advantages, making them attractive investments for many. REIT fraud occurs when bad actors try to sell REIT investments that turn out to be scams.

Some common tactics used in REIT fraud schemes are highlighted in the graphic below:

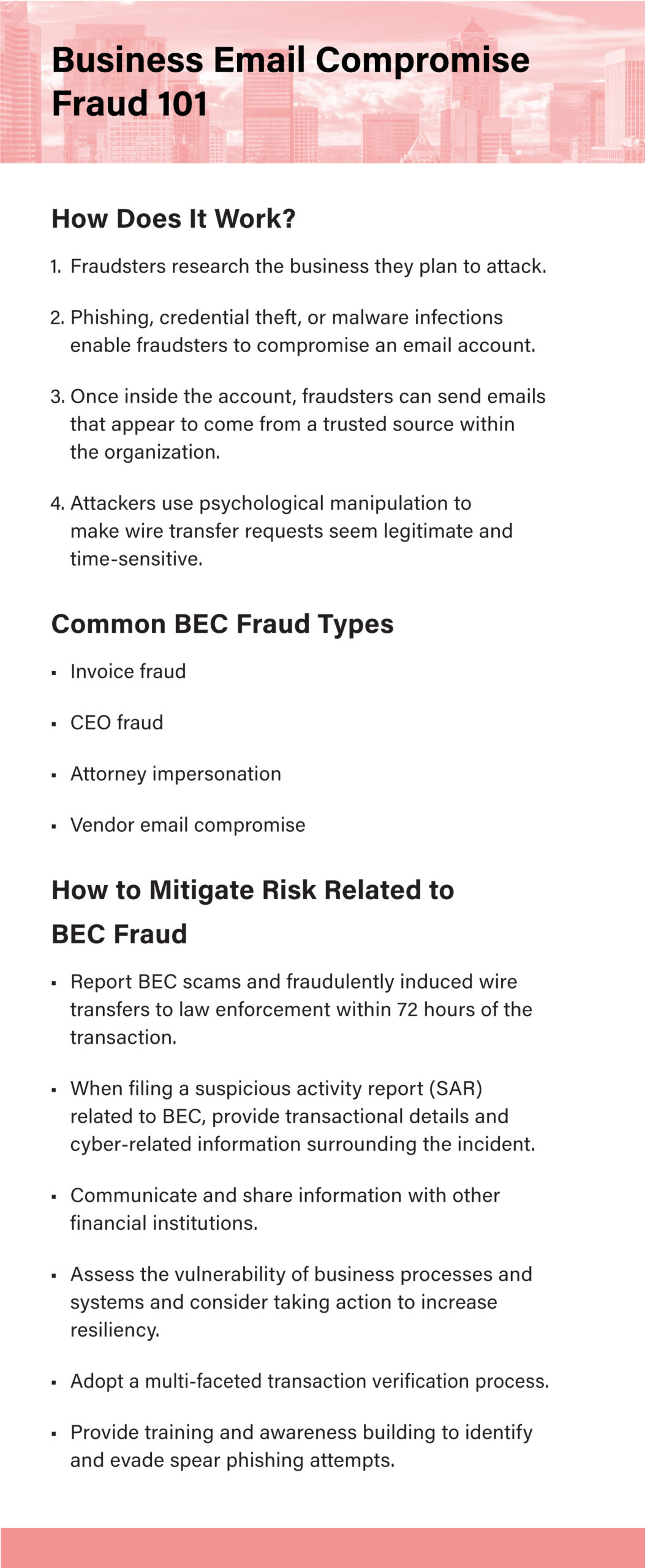

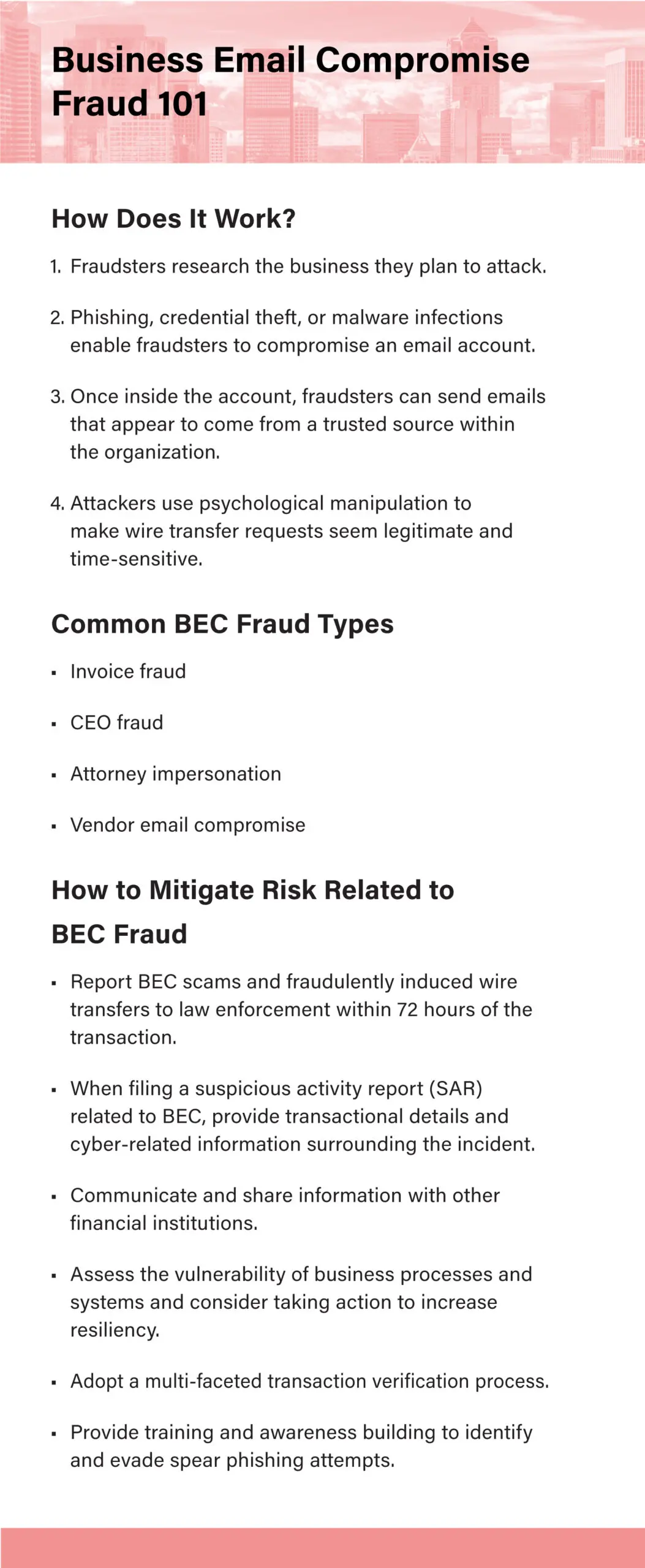

Business email compromise (BEC) fraud is a type of cybercrime where attackers manipulate or compromise email accounts with an organization to defraud the company or its employees. The 2022 FBI Internet Crime Report listed BEC scams among US networks’ top four major cybercrime threats. The report revealed that the real estate sector was the most targeted industry, with losses amounting to $2.7 billion. This marked the second consecutive year that the real estate sector was listed as one of the most targeted sectors. Security vendor Abnormal Security further highlighted the increasing severity of BEC scams in its H1 2023 threat analysis. According to the report, recorded BEC attacks grew by more than 81 percent in 2022.

The methods used to perpetrate BEC scams, as well as common typologies and how to effectively mitigate risk are outlined in the graphic below:

Fraud is a persistent and costly problem that affects real estate businesses of all types. As fraudsters become increasingly sophisticated, legacy, manual methods of fraud detection are no longer sufficient. This is where artificial intelligence (AI) plays a crucial role in bolstering fraud detection efforts. Reasons for its importance include:

See how ComplyAdvantage’s AI-powered Fraud Detection solution measures up against six other vendors here.

Learn how real estate businesses can respond to US authorities' new measures for improved corporate transparency and financial crime risk management.

Download Your CopyOriginally published 03 November 2023, updated 12 April 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).