The State of Financial Crime 2022

Stay on top of regional trends and novel criminal techniques so you can protect your business from financial crime.

Download nowThe first Financial Action Task Force (FATF) plenary under the two-year Singapore Presidency of T. Raja Kumar took place in Paris on October 20-21, 2022.

Discussions centered around:

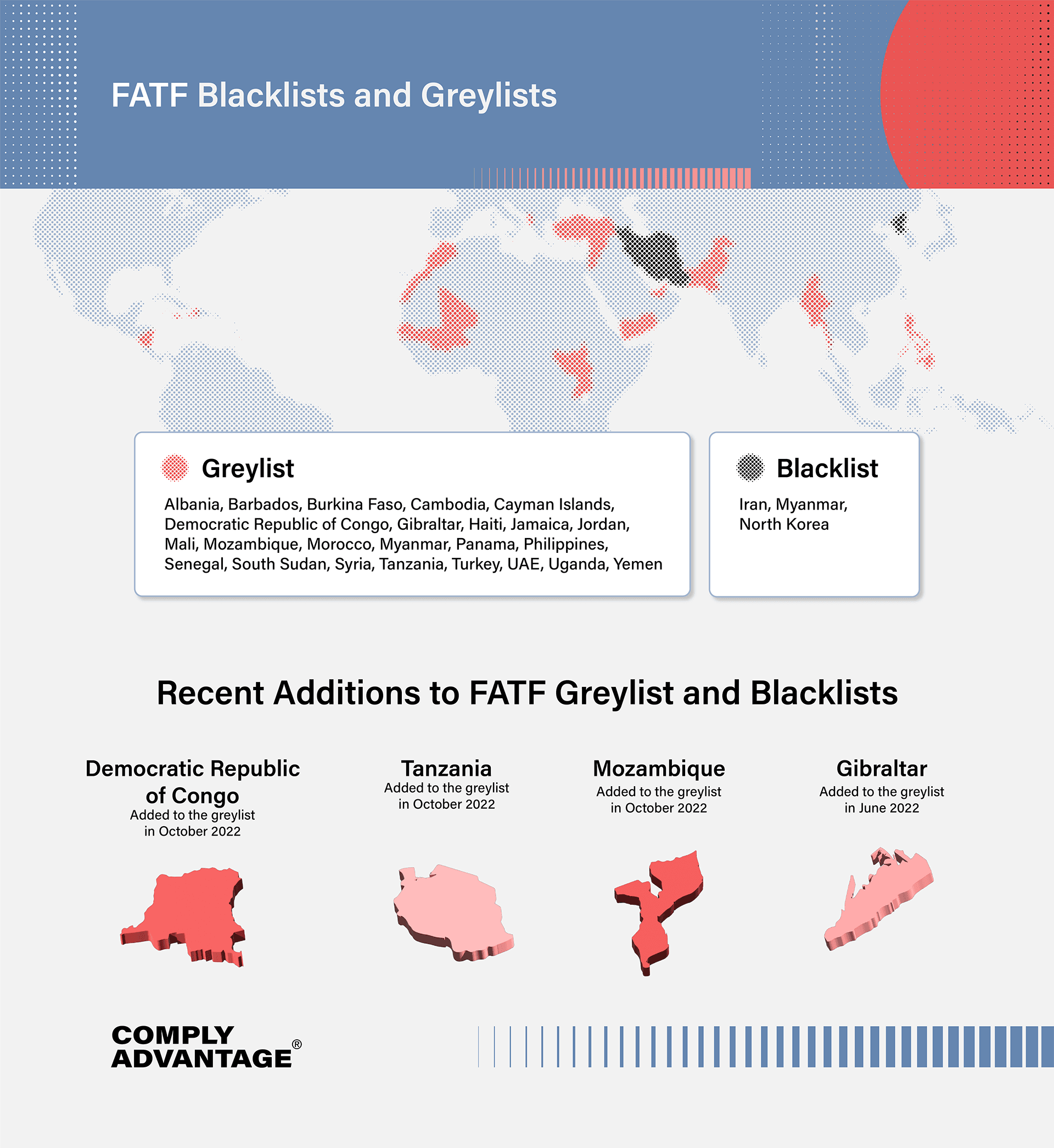

In February 2020, Myanmar committed to addressing the strategic deficiencies highlighted in the country’s 2018 MER. However, Myanmar’s action plan expired in September 2021, with no substantial progress having been made. In June 2022, the FATF strongly urged Myanmar to complete its action plan by October 2022. Due to a continued lack of progress and the majority of the country’s action items still not addressed a year beyond the action plan deadline, the FATF has added Myanmar to the blacklist.

Myanmar is the third jurisdiction to join North Korea and Iran on the FATF blacklist.

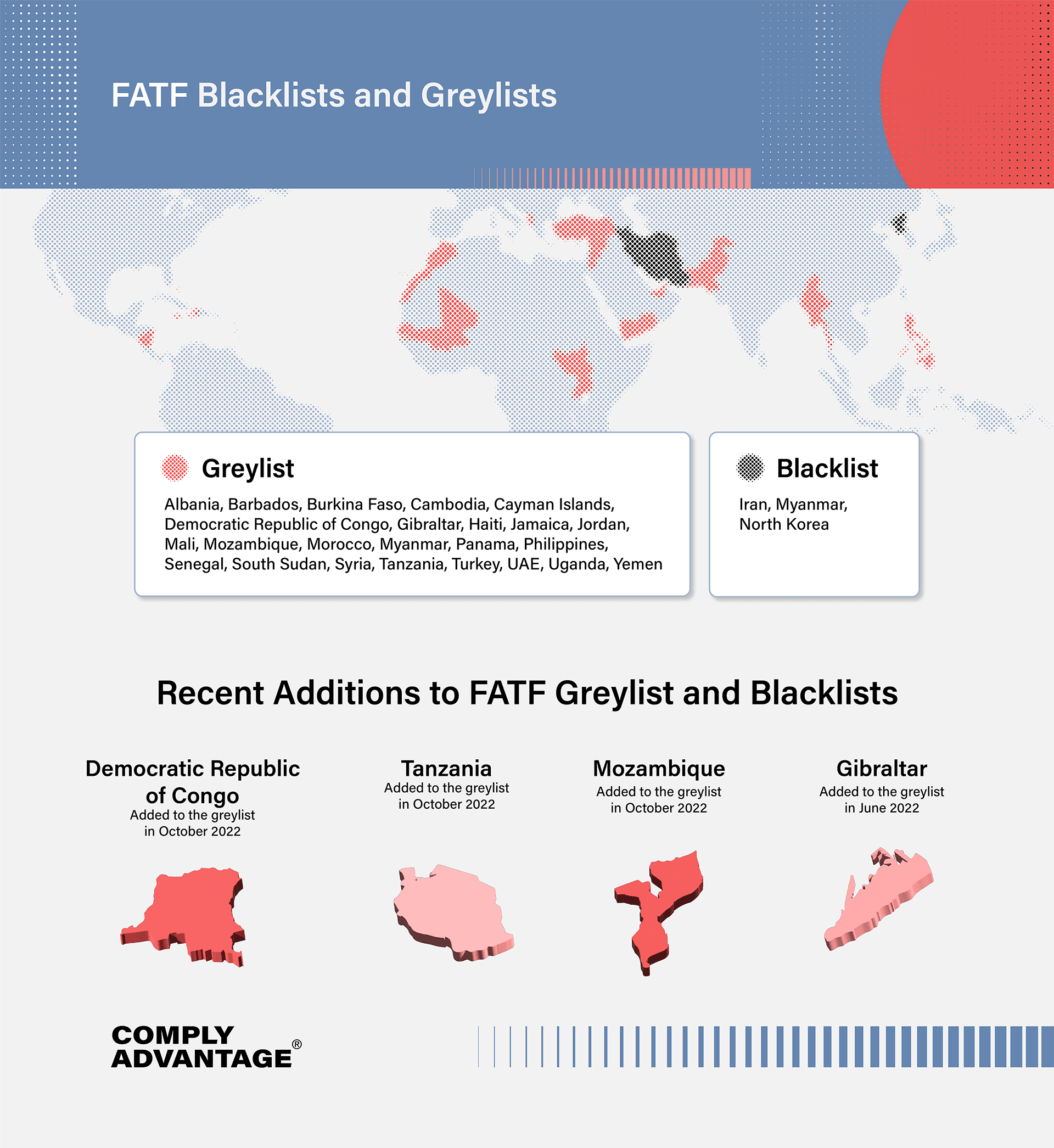

Following the FATF’s most recent update, the grey list currently consists of 23 jurisdictions. At the plenary, Kumar announced that the Democratic Republic of Congo (DRC), Mozambique, and Tanzania would now be subject to increase monitoring due to gaps in their anti-money laundering and combatting the financing of terrorism (AML/CFT) regimes. Pakistan and Nicaragua were removed from the grey list owing to sufficient progress in their proposed action plans.

The decision to add the DRC to the grey list was made due to insufficient progress by the country on the recommendations laid out in its latest Mutual Evaluation Report (MER). The FATF stated the DRC must fully address the identified gaps by implementing its action plan by 2025.

Following an MER in 2021, Mozambique made a high-level political commitment to addressing deficiencies in its domestic money laundering and terrorism financing regulations. While the FATF noted that the country had made progress on some of the MER’s recommended actions, sufficient progress had not been made, resulting in Mozambique being added to the grey list.

Following its MER in 2021, the FATF notes that Tanzania has made progress on some of the MER’s recommended actions to improve its AML/CFT system. However, the FATF has placed Tanzania on the grey list due to several outstanding action points yet to be completed.

Pakistan has appeared on the FATF greylist multiple times since 2008. In June 2022, the FATF said Pakistan would be kept on the list until an on-site visit to the country took place to verify its progress. At the Plenary, the FATF announced Pakistan would no longer be subject to increased monitoring due to the country’s significant progress in improving its AML/CFT regime.

After returning to the grey list in February 2020, the FATF has announced Nicaragua is no longer subject to increased monitoring. While the FATF congratulated Nicaragua on improving its AML/CFT regime, strong caution was given on the potential misapplication of the FATF Standards resulting in the suppression of Nicaragua’s non-profit sector. The FATF encouraged Nicaragua to ensure its oversight of non-profit organizations is risk-based and in line with the FATF Standards.

In light of the ongoing Russian invasion of Ukraine, the FATF announced additional restrictions on the country’s remaining role as a member of the inter-governmental body. Russia is now barred from participating in current and future FATF project teams and will be excluded from meetings of the FATF-Style Regional Bodies.

These measures expand on the actions the FATF took back in June, when it stripped Russia of its leadership positions, among other restrictions. Kumar noted that the FATF would continue to monitor the situation and consider at its plenary meetings whether grounds exist for lifting or modifying these restrictions.

Following statements issued in March, April, and June this year, the FATF reiterated that all jurisdictions must be vigilant to emerging risks from the circumvention of measures taken against Russia to protect the international financial system.

Echoing Kumar’s objectives presented at the June 2022 plenary, the FATF discussed multiple strategic initiatives ranging from improving asset recovery and beneficial ownership transparency to providing guidance on detecting illegal fentanyl trafficking.

The FATF reiterated its focus on accelerating the successful recovery of funds that fall victim to illicit financial flows. Delegates at the plenary agreed that expediting existing schemes and proposing new operational strategies will help countries develop more robust operational systems, which will help drive greater asset recovery.

The FATF also formally agreed to undertake three projects to enhance global anti-corruption efforts. First, the FATF will assess the illicit finance risks posed by the misuse of “citizenship by investment” and “residency by investment” schemes, commonly known as “golden passports.”

Second, through mutual evaluations, the FATF will enhance assessments of countries’ efforts to implement the United Nations Convention Against Corruption, the international legal convention for national anti-corruption legal frameworks.

Third, the FATF will evaluate members’ compliance with the FATF Recommendations related to non-financial professionals and gatekeepers whose professional expertise and access can enable corruption.

FATF members agreed to release draft guidance for public consultation related to Recommendation 24 concerning beneficial ownership transparency for legal persons and proposed amendments to Recommendation 25, which aims to improve beneficial ownership transparency for trusts and similar legal arrangements.

The FATF notes that it welcomes a range of views from companies and other legal persons, financial and non-financial sector businesses, and non-profit organizations. Public consultation on these recommendations is open until December 6, 2022, with the finalized guidance and changes expected to be implemented by February 2023.

Finally, the FATF announced it would publish a report in mid-November that will include risk indicators to help detect and disrupt financial flows linked to the growing illicit trade in fentanyl and other synthetic opioids.

Despite most jurisdictions recognizing drug trafficking as a major predicate offense for money laundering, the FATF noted that investigations and prosecutions related to fentanyl trafficking remain low. Therefore, the report will include training for prosecutors and law enforcement to help them better understand the supply chain and the need for public-private partnerships to share information and help the private sector improve its suspicious activity reporting.

Compliance staff should ensure they are familiar with the outcomes of the October plenary – particularly relating to any upcoming MERs in countries they operate in. Dates related to forthcoming guidance issued by the FATF should also be noted. Such guidance will help shape and inform the future regulatory approach national bodies take.

The next FATF plenary is due to take place in February 2023.

Previous plenary coverage from ComplyAdvantage can be found here:

Stay on top of regional trends and novel criminal techniques so you can protect your business from financial crime.The State of Financial Crime 2022

Originally published 27 October 2022, updated 28 October 2022

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).