Understanding Where The Money Comes From

Learn more about instances where compliance teams must go a step beyond identifying and verifying their customers.

Read Part 3At the onboarding stage, there may be instances where compliance teams need to go a step beyond identifying and verifying their customers. While not every transaction will be subject to increased scrutiny, it’s important compliance teams have the right risk-based protocols in place when new or existing customers present a higher risk of money laundering or terrorist financing.

Part 3 of The Compliance Team’s Guide to Customer Onboarding discusses what these protocols can look like, including identifying an account’s beneficial owner, verifying a customer’s source of funds and wealth, and subjecting a third-party payor to the onboarding process.

The term “beneficial owner” refers to the person or persons that have ultimate control over the funds in an account. During the due diligence process, compliance teams must identify an account’s ultimate beneficial owner and determine whether they’re legitimate or attempting to hide behind structures to launder money or finance terrorism.

The percentage of control often determines beneficial ownership. For AML purposes, most jurisdictions require beneficial ownership information to be collected at a threshold of 25% or more. This means onboarding teams must identify every customer who owns at least 25% of a company. Each organization sets its own appropriate threshold. For high-risk customers, the beneficial ownership threshold can be as low as 10%.

However, the goal is more than figuring out who owns what percentage. The other key issue is “control.” In some cases, it is possible that an individual not meeting the ownership threshold can exercise control over the presenting entity. This is crucial when determining what degree of due diligence is appropriate for someone. For instance:

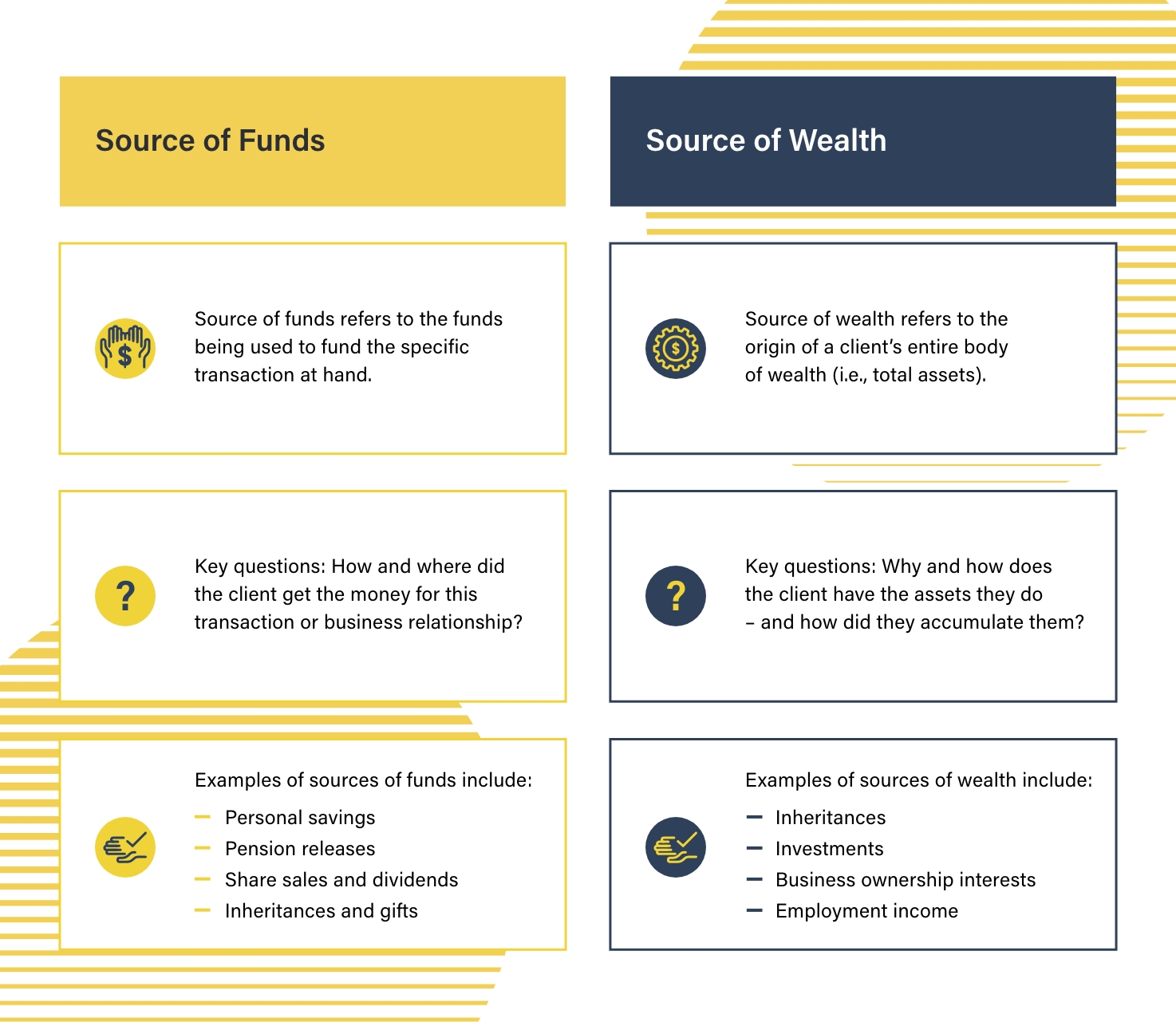

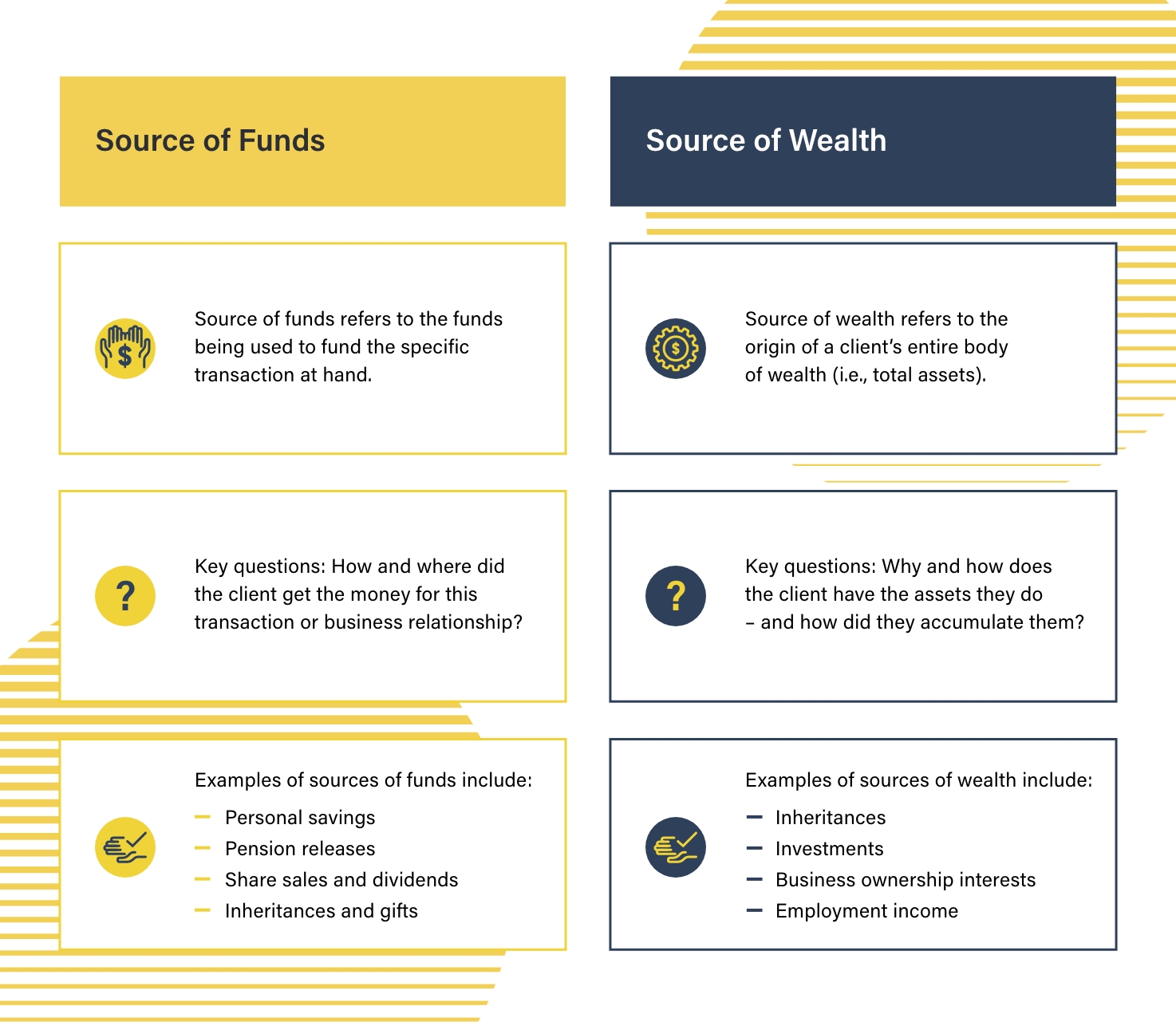

Understanding where customers have acquired the funds they use to transact and invest is another essential component of the KYC process. In some cases, particularly with legal entities, compliance staff must determine both the customer and the beneficial owner’s source of funds (SOF) and wealth (SOW). The differences between these concepts and key questions to ask during the determination process are listed in the graphic below.

Compliance teams must record the information they used and how it influenced their judgment about the client’s SOF and SOW. These records should be stored and secured with the other onboarding due diligence records and available for later inspection.

The receipt of payments by third parties typically presents little money laundering or terrorist finance risk. But when firms don’t know a third-party payor, compliance teams need to understand the rationale behind the payment.

To fulfill their compliance obligations and avoid facilitating criminal activity, organizations must be able to accurately assess the third-party money laundering risks that they face on an individual basis. Some key questions to ask include:

If the onboarding team cannot determine a reasonable commercial rationale for the third-party payment, then the third party’s SOF and SOW should be determined. In these cases, the third-party payor should be subject to the same due diligence measures as a new customer.

Uncover more risk management best practices throughout each section of The Compliance Team’s Guide to Customer Onboarding, including:

Learn more about instances where compliance teams must go a step beyond identifying and verifying their customers.

Read Part 3Originally published 05 December 2022, updated 13 January 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).