Know Your Business (KYB)

Build trusted relationships with streamlined business onboarding

- Tailor your onboarding process to the risk of the customer

- Seamlessly integrate within the onboarding journey

Want to see it in action?

Request Demo

A KYB solution that delivers multi-dimensional value

to onboard a customer

By automating the KYB workflow without compromising on risk.

Increase in conversion

Achievable by accelerating the speed at which accounts are opened.

Increase in cases processed per month

Without increasing headcount by using dynamic risk scoring to improve case allocation.

How is KYB from ComplyAdvantage different?

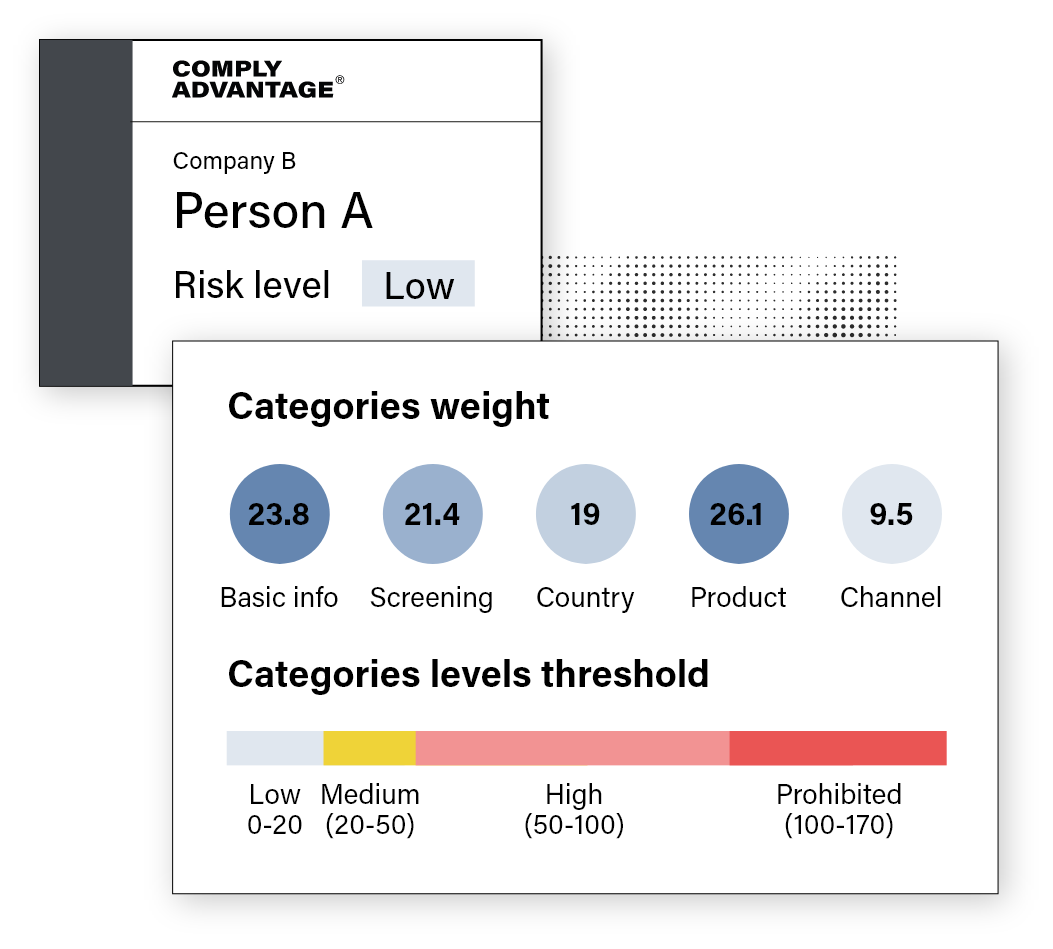

Multi-layered risk scoring

World’s only real-time risk database

“As a digital trade finance platform, automated onboarding and efficient KYB is critical for 40Seas. ComplyAdvantage’s KYB solution was really easy to get up and running.

We’re able to verify our customers in seconds, improving the customer experience and ensuring we can mitigate risk effectively”

~ Igor Zaks, Co-founder and Chief Risk Officer, 40Seas

How does the KYB process work?

Explore related AML solutions

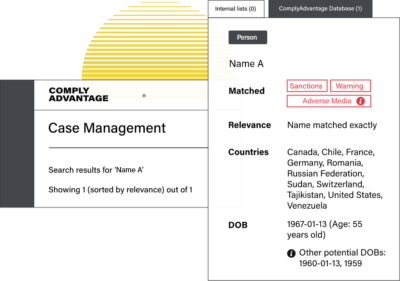

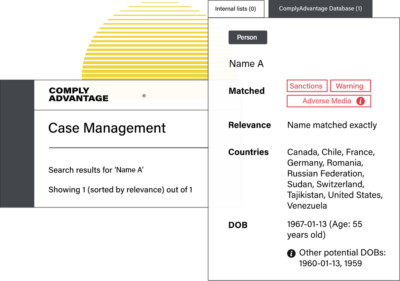

Sanctions & Watchlists Screening

Automate customer onboarding and monitoring with a real-time AML risk database and an effective KYC solution.

Discover Sanctions & Watchlists Screening

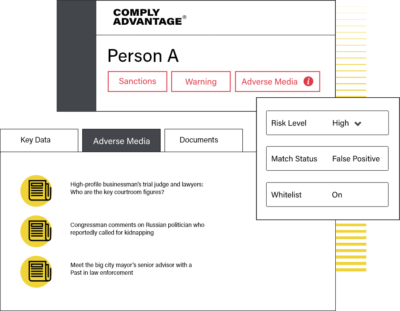

Adverse Media Screening

Cut through the noise and analyze true adverse media context at scale with our robust adverse media screening software.

Discover Adverse Media Screening

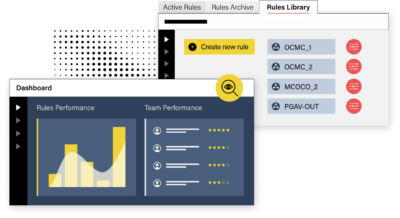

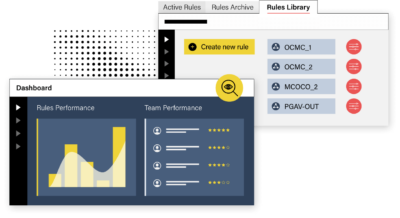

Transaction Monitoring

Powered by AI, our transaction monitoring solution offers a no-code, self-serve rules builder and can be scaled to billions of transactions.

Discover Transaction Monitoring

Know Your Business FAQs

KYB by ComplyAdvantage helps you reduce the cost of customer onboarding while delivering a better experience and protecting the business from high-risk business relationships. With our easy to use, unified KYB and AML management platform, you can enhance your decision making processes and reduce friction by utilizing the solution in your internal systems through a REST API.

Yes. Data relating to UBOs, directors, and other associated entities can be added to each created case. This includes client-declared information, details you may have retrieved from other regional registries (e.g., UK Companies House), and information garnered through analyst investigations.

Through the solution’s dynamic risk scoring functionality, you can apply your own risk formula and get alerted if the score updates due to a change in perceived risk.

Get started with ComplyAdvantage today

Streamline your Know Your Business Processes. Schedule a demo to see how KYB can make your job easier.

Request Demo