Sanctions & Watchlists Screening

Protect your organization with a robust watchlists and sanctions screening tool that offers real-time insights into your clients’ risk statuses.

Learn moreSanctions represent an important tool for governments around the world and are used to achieve foreign policy goals or to punish violations of international law. Sanctions regimes involve the application of economic restrictions against a range of foreign targets, from nations and government regimes to organizations and individuals. In order to ensure their measures have the desired effect, governments may seek to apply economic restrictions not only to persons within their jurisdiction but to persons in foreign jurisdictions who trade with their sanctions targets.

This approach to sanctions enforcement entails two categories of international sanctions, known as “primary” and “secondary” sanctions. Firms that do business with foreign customers and clients, or have foreign partners and suppliers, must understand how the different categories of sanctions apply and, importantly, how to achieve compliance.

Primary sanctions are economic restrictions that require compliance from persons within the issuing country. In the United States, for example, the Office of Foreign Assets Control (OFAC) may impose a range of sanctions directly against foreign targets. US persons and obligated entities must then screen their customers against the OFAC sanctions list to ensure that they are not doing business with a sanctioned person.

OFAC primary sanctions: OFAC sanctions are imposed in accordance with the US sanctions regime, directly against countries, organizations, and individuals that the US government deems to be guilty of international crimes or working against US national security interests. US sanctions targets currently include (but are not limited to): North Korea, Russia, Cuba, Iran, Syria, and Chinese military companies.

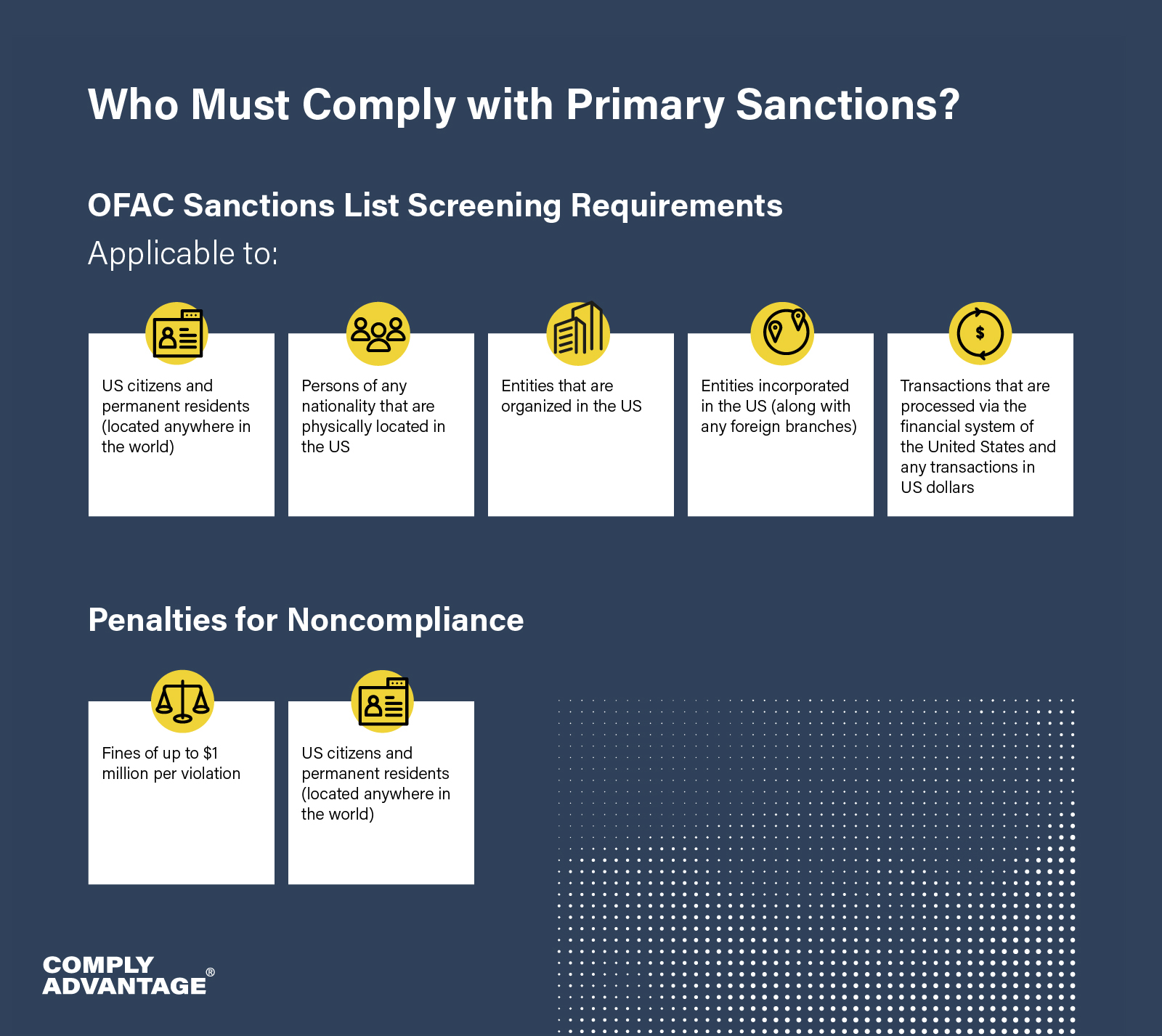

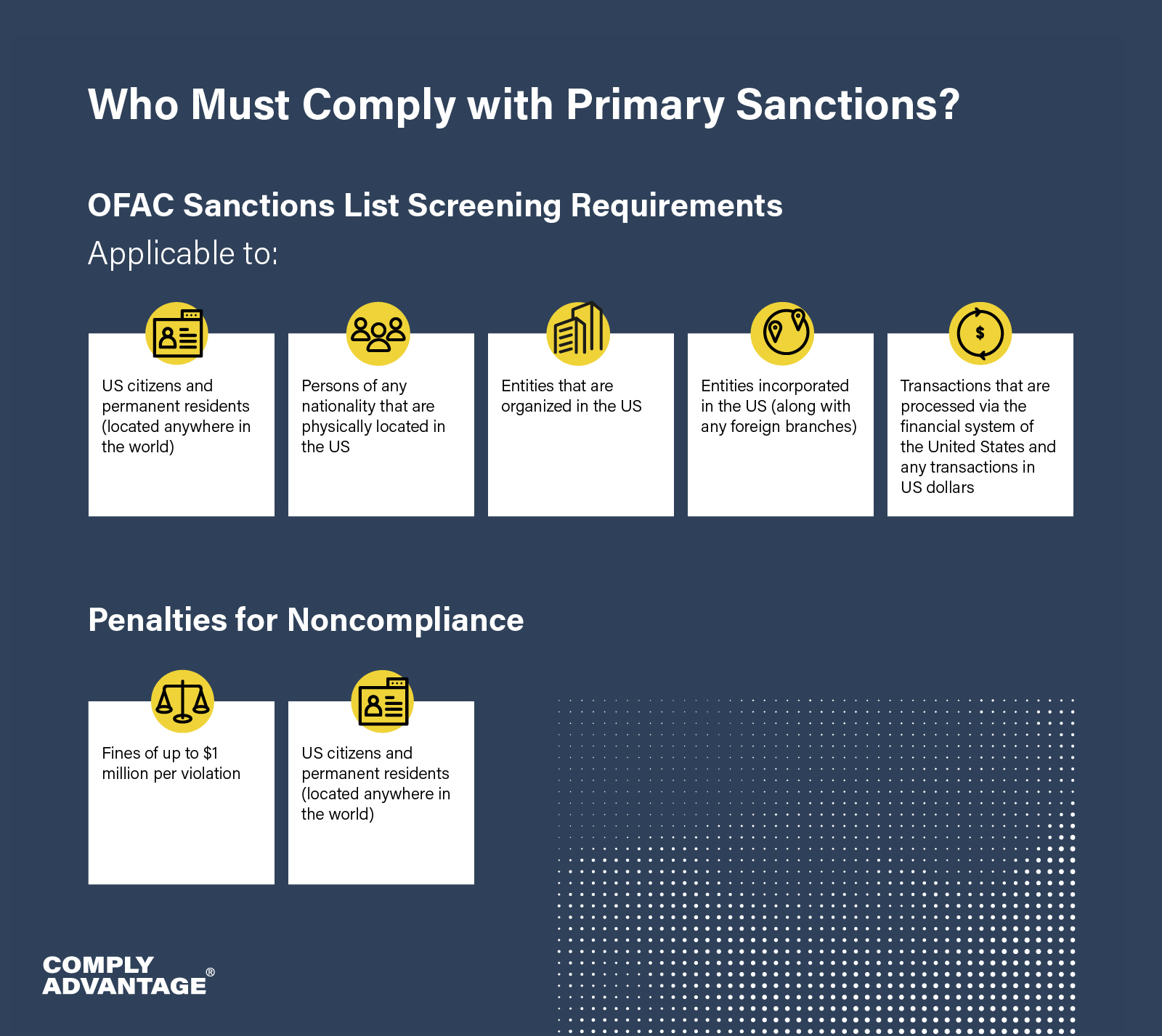

US primary sanctions generally apply to any transactions that have a nexus to the United States’ jurisdiction, this includes:

US persons are restricted or forbidden from trading with persons within sanctioned countries and face significant penalties for noncompliance. OFAC primary sanctions violations may result in fines of up to $1 million (per violation) and prison sentences of up to 20 years.

Secondary sanctions are economic sanctions issued against foreign companies or individuals that are trading with countries subjected to primary sanctions. Essentially, this means that third parties that are not based in or citizens of an issuing country face penalties for doing business with the targets of the issuing country’s sanctions regime.

Secondary sanctions are intended to enhance the effects of primary sanctions but also serve to protect the national security interests of the issuing country on a global basis by discouraging third parties from engaging in harmful actions. Penalties for noncompliance with secondary sanctions generally manifest as a prohibition on doing business with the issuing country or a restriction of access to the issuing country’s financial system.

OFAC secondary sanctions: In the US, OFAC secondary sanctions support the objectives of primary sanctions programs against countries such as Iran and North Korea. The secondary sanctions regime functions to protect US national security interests by preventing non-US third parties from engaging in a range of specified trade activities with those targeted countries.

Examples of US secondary sanctions imposed against non-US persons include:

Non-US entities with business relationships in the United States must comply with secondary sanctions. Penalties for violating secondary sanctions include degrees of exclusion from the US economic system, which might mean prohibitions on importing goods from, or exporting goods to, the US. Persons that violate secondary sanctions may also be added to the US SDN list.

Compliance with primary and secondary sanctions is an important priority for multinational firms or firms that do business with foreign clients. While firms may be familiar with the primary sanctions that apply within their regulatory environment, and screen customers regularly against the relevant sanctions lists, compliance with secondary sanctions requires firms to expand the scope of their screening solutions to include a broader range of international sanctions. UK firms that do business with clients in the US and clients in Russia, for example, must screen against both the UK Sanctions List and the OFAC Sanctions List – or risk violating US restrictions.

Whether dealing with primary or secondary sanctions, effective sanction screening solutions should be capable of capturing up-to-date data quickly and accurately, while minimizing false positives and administrative noise. Firms should seek to integrate suitable software tools to optimize the screening process and effectively manage a range of sanctions compliance challenges, such as the use of aliases, non-Western naming conventions, and non-Latinate characters.

Blocking laws: When governments deem secondary sanctions to be unreasonable, they may implement regulations known as ‘blocking laws’.

Designed to protect domestic business interests from foreign regulations, blocking laws seek to undermine secondary sanctions, penalizing domestic firms that comply with them while authorizing civil suits for firms that suffer financial damages as a result of their noncompliance. Recent examples of blocking laws include the EU’s Blocking Statue, implemented in 2018 to prevent compliance with US sanctions on Iran, and China’s Blocking Rules, implemented in 2021 as a response to escalating economic tensions with the US.

Protect your organization with a robust watchlists and sanctions screening tool that offers real-time insights into your clients’ risk statuses.

Learn moreOriginally published 13 May 2021, updated 06 November 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).