The State of Financial Crime 2023

Explore the trends shaping today's financial landscape and their implications for the year ahead.

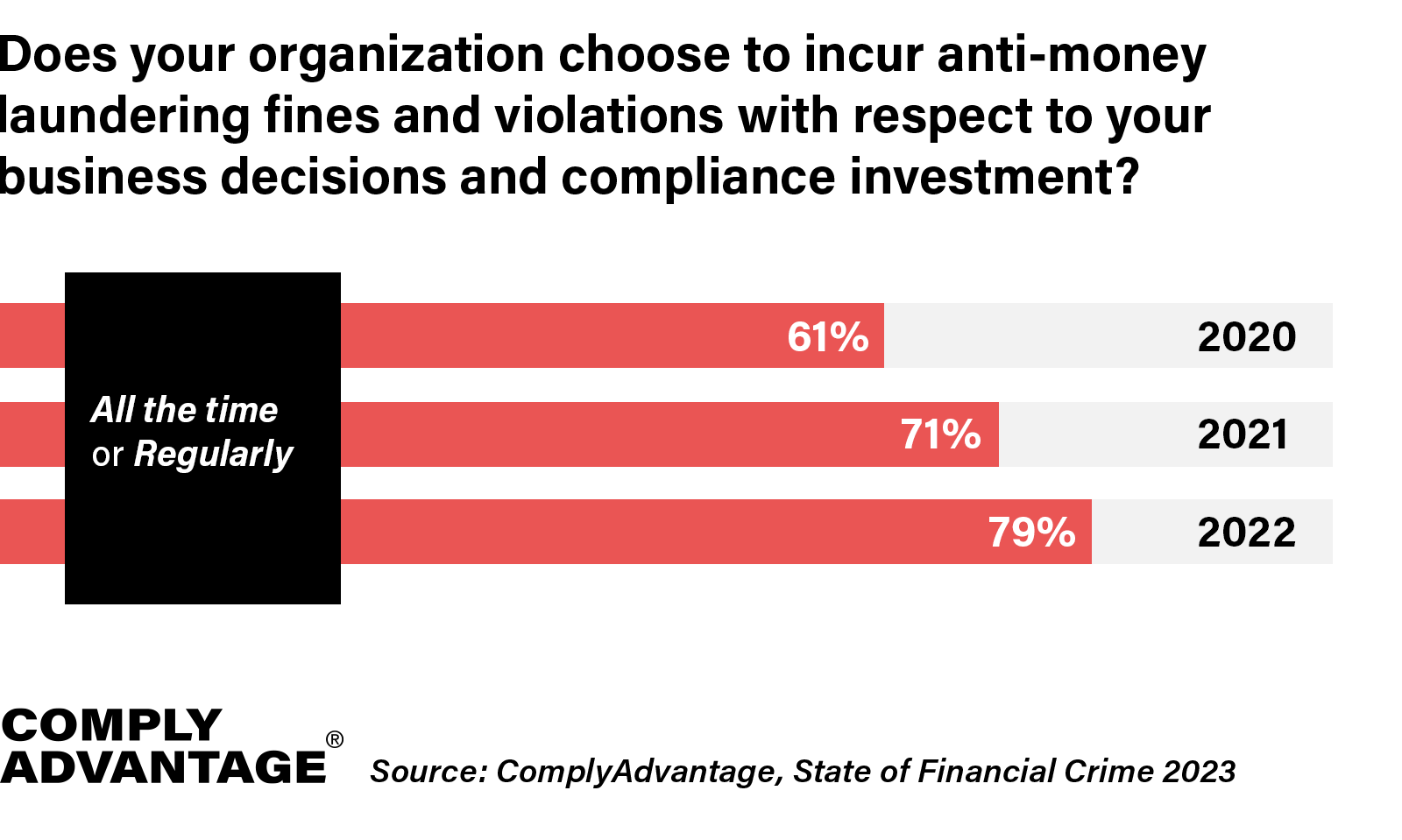

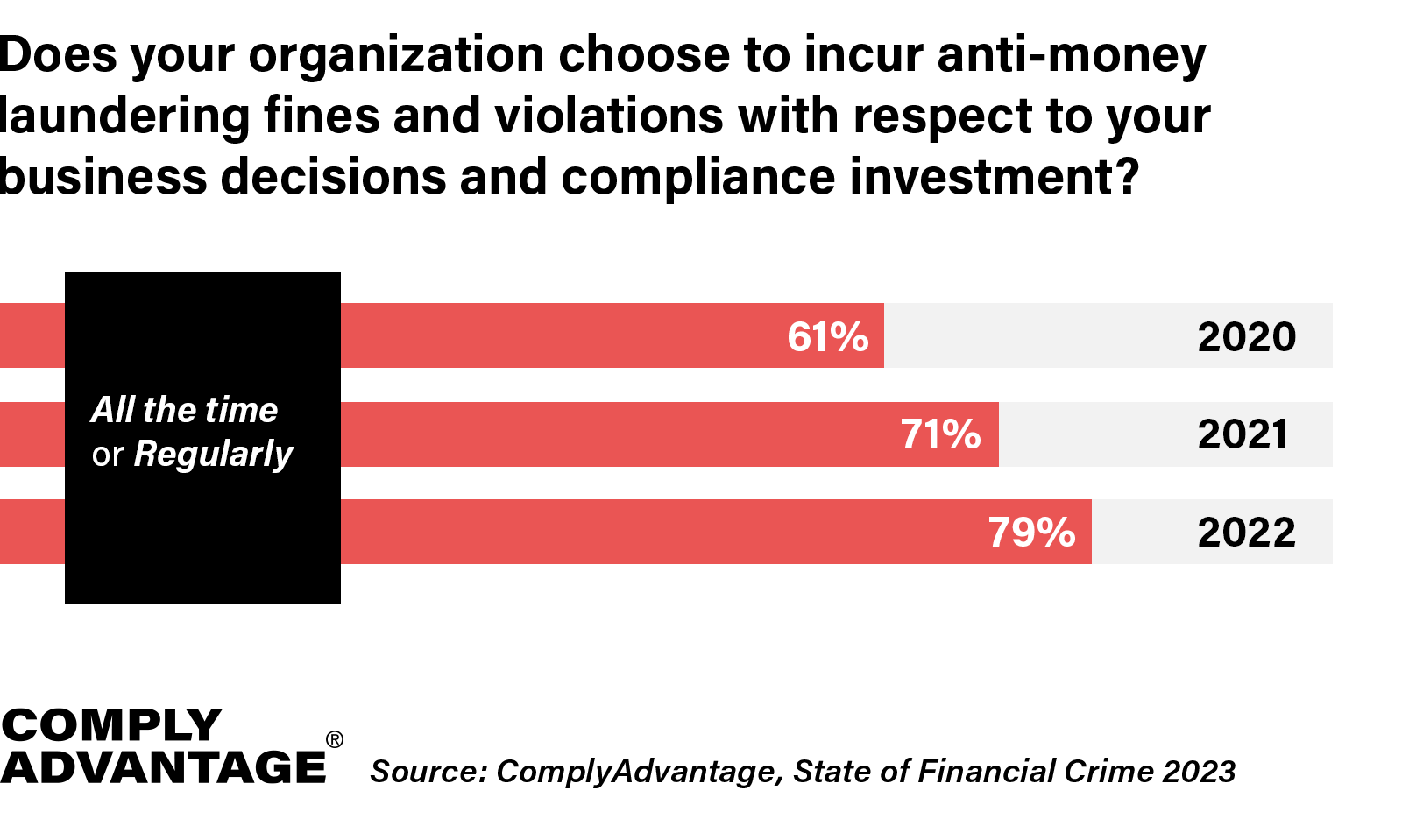

Download nowOur 2023 global compliance survey asked 800 C-suite and senior compliance decision-makers across North America, Europe, and Asia Pacific if they regularly consider the risk of and/or choose to incur anti-money laundering (AML) fines and violations with respect to their business decisions and compliance investment.

For the third consecutive year, there was a pronounced rise in the number of firms telling us they choose to incur AML fines and make violations “all the time.” This number, 61 percent in 2020, had risen to 79 percent by 2022.

The reasons behind this trend are likely complex, but raise the question: Are firms becoming desensitized to the threat of fines? In this article, we look at some of the top AML fines in 2022 and consider the type and nature of the violations that earned the steepest financial penalties.

In 2022, global fines for failing to prevent money laundering and other financial crime surged more than 50 percent, with many firms, particularly in the UK and the US, committing repeat infractions.

While fines are typically issued several years after AML failings occur, the top AML fines incurred in 2022 occurred across the following sectors:

In 2022, the Securities Exchange Commission (SEC) and the Financial Conduct Authority (FCA) ordered over $6 billion worth of fines and restitution payments to various trading and brokerage firms.

One of the fines was issued as a result of a long-running fraud scheme that involved concealing the immense risks of a complex options trading strategy. In this case, the SEC discovered that several senior staff members had misled institutional investors to believe their funds were protected against any sudden stock market crashes by hedges that were implemented as part of the fund’s investment portfolio.

However, when the cost of the hedges rose significantly, the senior officials secretly purchased less effective and cheaper hedges that provided a reduced level of protection. Investors were also provided with altered documents that concealed the true risk of the funds’ investments, including the fact that cheaper hedges had been bought. However, the economic volatility of COVID-19 exposed the products’ true risk, resulting in the loss of over $5 billion in investor funds. Following the investigation, the SEC issued a $1 billion fine and ordered the investment firm to pay over $5 billion in restitution to victims in light of the firm’s failure to conduct effective oversight and verify investment activities.

Additional AML infractions from investment firms were penalized by the FCA. One firm was fined over £2 million for failing to implement adequate procedures, systems, and controls to mitigate the risk of being used to facilitate fraudulent trading. The financial watchdog also discovered a circular pattern of purported trades, which appeared to have been carried out to allow tax reclaims to be withheld in multiple European countries.

Bank AML fines in 2022 reached far and wide across the globe, totaling over $2 billion in civil monetary penalties. In one of the largest fines of 2022, a European bank was found to have insufficient transaction monitoring of high-risk customers and inadequate enhanced due diligence (EDD) measures. The bank also made fraudulent representations to other international banks, claiming their deficient AML systems were actually effective.

The FCA also fined several banks for failing to conduct sufficient checks for money laundering and terror financing, while processing deposits from customers in high-risk countries. In one case, the FCA noted that a bank had also failed to undertake the required checks for some politically exposed persons (PEPs) and had inadequate compliance staff to perform the work required.

The Financial Crimes Enforcement Network (FinCEN) also issued a series of hefty fines in 2022, including a $140 million civil money penalty against a bank in light of it willfully failing to implement and maintain an AML program that met the minimum requirements of the Bank Secrecy Act (BSA). FinCEN also noted that the bank failed to accurately and timely report thousands of suspicious transactions.

The gambling sector saw an onslaught of AML fines in 2022, with the Australian Transaction Reports and Analysis Centre (AUSTRAC) issuing a large fine to an entertainment group that permitted its customers to move money through payment channels that were non-transparent and involved high money laundering and terrorist financing risks. According to the regulator, the group also failed to identify the source of funds (SOF) moving through these channels or whether there was a risk that the source of funds was illicit.

The UK Gambling Commission issued its largest fine to date in 2022 after an investigation revealed money laundering and social responsibility failings. Some of the AML compliance failures included:

2022 also saw the New York State Department of Financial Services (NYDFS) announce a $30 million financial penalty for significant crypto-related AML, cybersecurity, and consumer protection violations. Marking the NYDFS’ first-ever crypto-sector enforcement, the firm’s AML failings included:

Additionally, the NYDFS found critical failures in the firm’s cybersecurity program. The program did not fully address the firm’s operational risks, and some policies within the program did not comprehensively comply with several provisions of the Department’s Cybersecurity and Virtual Currency Regulations.

European regional regulators issued various fines to asset management firms in 2022, specifically those that failed to monitor their clients and promptly report any suspicious activity to a Financial Intelligence Unit (FIU). In one case, the Netherlands Authority for the Financial Markets (AFM) discovered a firm had not appropriately classified some of its clients into risk categories. Consequentially, it was found that of the company’s 250,000 plus accounts, only two clients had received the risk classification “provisionally unacceptable.”

In 2022, financial institutions were fined over $8 billion for AML-related infractions, bringing the gross amount of AML fines since the global financial crisis (2007-2008) to an estimated $56.1 billion. In light of the examples listed above, the violations that received the biggest penalties leaned toward repeated violations and failure to effectively calibrate AML measures with a firm’s risk profile, including:

In each case, the failures above reiterate that in order to effectively monitor a firm’s customers, they need to know who their customers are.

According to our global compliance report, when asked which area of their compliance function would be at risk in an audit, 48 percent of firms (the highest proportion) told us it would be their knowledge of regulations. To ensure future audits go as smoothly as possible, compliance staff should be aware of the following upcoming AML regulations in 2023:

Explore more by downloading our Regional Regulatory Trends report today.

Given that 79% of our survey respondents said they choose to incur AML fines and make violations “all the time,” it is clear that many firms are experiencing “enforcement fatigue.”

According to Iain Armstrong, Regulatory Affairs Specialist at ComplyAdvantage, compliance officers will need to keep their businesses focused on good outcomes by emphasizing the human, as opposed to financial, cost of financial crime more than ever. Indeed, firms should not be complacent about the longer-term reputational effects of widely-publicized fines and enforcement actions, particularly with the oldest of the millennial generation starting to enter middle age.

To mitigate the risk of incurring AML fines in 2023, firms should:

Explore the trends shaping today's financial landscape and their implications for the year ahead.

Download nowOriginally published 28 February 2023, updated 08 August 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).