The Role of Tech and Talent in Adverse Media

Uncover the motivations behind investing in more advanced screening solutions in tandem with how and where to leverage talent best.

Download the Report NowAdverse media screening has become essential in identifying potential customer risks as companies strive to protect their assets, reputations, and stakeholders. While the importance of negative news screening is widely recognized, implementing an effective and comprehensive screening process remains complex for many firms. One of the key obstacles organizations face is the existence of screening gaps, where critical information may slip through the cracks, leaving businesses exposed to potential breaches.

In a webinar with industry experts from the Financial Action Task Force (FATF) and leading research and advisory firm Celent, discussions centered on how technology can be used to close gaps in the negative news screening process. Based on their conversations, this article explores how financial institutions (FIs) can mitigate common challenges and reduce risk in adverse media with machine learning (ML).

When dealing with negative news screening, the main challenge analysts face is having to sift through vast amounts of data to identify relevant information. One major issue is the prevalence of irrelevant or noisy data. For example, searching for “Tiffany Palmer” on Google will generate over 70,000 results, even when using specific keywords like fraud or money laundering. This means it can be difficult to find the relevant information. For people with common names, such as John or James Smith, the number of search results can balloon to around 30 million, making it a daunting task to find the right information.

When analysts are unable to narrow down their search, difficulties can arise. They may have some information about their customer, such as their date of birth or location, but using tools like Google to refine their search is not always practical. Many try to read through all the available pages, but it’s not an effective or time-efficient solution. It remains hard to distinguish between relevant and irrelevant information, and it can be challenging to determine if two people with the same name are the same person.

Another challenge relates to keeping track of a customer’s risk information over time. It’s not practical to research millions of results for every update. To tackle this issue, some companies hire multiple analysts to read articles and use basic rules to filter out irrelevant data. However, this approach is limited since it either restricts the amount of information each analyst reviews or requires more analysts to cover the vast amount of data.

Some may choose to ignore the problem, while others only focus on performing adverse media checks on a small group of high-risk customers. Unfortunately, this may not effectively address possible risks since those involved in financial crimes may not be easily identifiable as high-risk customers.

With information coming from various sources, including fake news, satirical content, and extremist websites, assessing the quality and credibility of the data becomes difficult. Thorough diligence on each source becomes necessary, adding complexity to the process.

Relying solely on well-known sources, such as national-level newspapers, is not advised, as this approach may miss individuals and risks not considered nationally important. The emphasis is on identifying risks before they become widely known, highlighting the need for a comprehensive and efficient solution to address the challenges of adverse media screening.

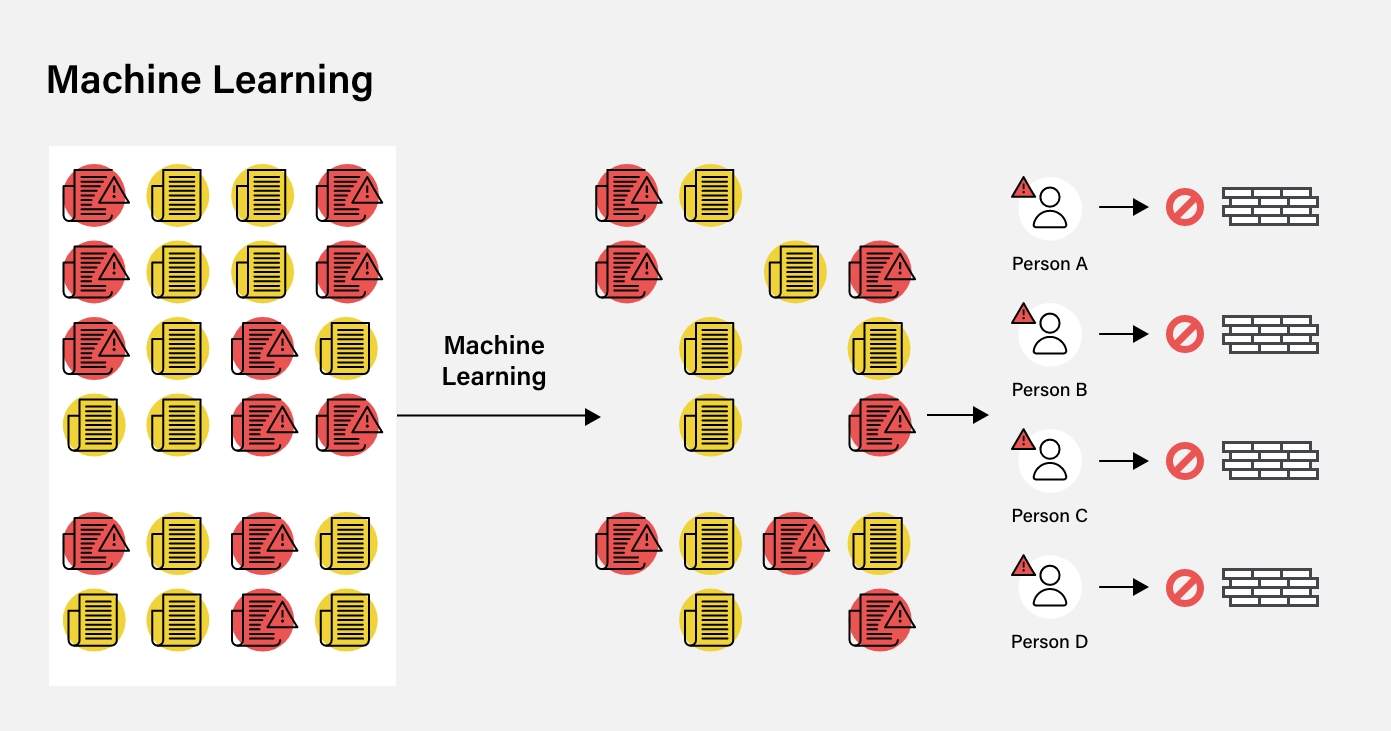

ML offers automation, providing the capability to continuously monitor vast amounts of media without being restricted to a specific set. This ensures FIs are aware of potential risks that may impact them. Additional features of ML that can help mitigate the common challenges listed above include:

Firstly, the ability to access advanced infrastructure has significantly improved, allowing smaller organizations to access previously limited resources to larger entities. Cloud service providers offer readily available and cost-effective hardware for tasks like data retrieval and processing, leveling the playing field for various companies.

Secondly, remarkable advancements in machine learning, particularly in hardware and infrastructure, have played a crucial role in driving developments in ML. Silicon chips designed for ML tasks have become more powerful and accessible. This has allowed organizations to harness ML models’ potential without investing heavily in expensive servers and technology. Furthermore, the availability of cloud services allows them to operate efficiently in their chosen regions, accommodating diverse data requirements and regulatory constraints.

Moreover, the progress in ML techniques, exemplified by advancements in natural language processing, has revolutionized the field. What was once considered impractical is now a reality, with ML becoming a potent tool in combating financial crime and identifying adverse events with remarkable accuracy.

The influx of real-world data has fueled the growth of ML, making it more relevant and applicable to solving significant problems. The industry now boasts around a million people dedicated to hand-labeling and annotating ML training data, making this valuable resource accessible through various mechanisms.

Uncover the motivations behind investing in more advanced screening solutions in tandem with how and where to leverage talent best.

Download the Report NowDespite the well-known challenges of adverse media screening and the awareness of these technological advancements, the widespread effective, integrated adoption of these solutions remains limited. Various factors may be influencing this hesitation among different organizations, despite the potential benefits these technologies offer.

As a result, attempts have been made to address the negative news problem through different approaches.

As mentioned previously, the first approach involves employing human analysts to review news and manually create searchable profiles. However, this method has limitations, as it is constrained by the number of analysts hired, which restricts the scope of media coverage. Additionally, challenges such as language disparities and lack of consistency persist.

The second approach adopted by FIs is a keyword-based method. While more scalable and automated, it has drawbacks, including a higher likelihood of false positives. Using keywords like “shoot,” “killed,” or “terrorize” can yield results with varying contexts, making it difficult for financial services firms or compliance departments to obtain relevant information. Conversely, this approach may also fail to capture critical information in an article when specific keywords are absent.

Considering the limitations of these two approaches, why do some organizations remain hesitant to adopt an ML-based approach to adverse media screening?

ComplyAdvantage has developed an innovative approach for its adverse media screening process. The API-led system comprises two main components. Firstly, there is a search bar where customers can input a person’s name and relevant identifying information, such as country or date of birth. The system then processes this data to identify potential risk profiles that match the customer’s search criteria, aiding the onboarding process.

The second part of the process involves gathering information from various sources on the internet. ComplyAdvantage utilizes ML technology to analyze and categorize this unstructured data, creating profiles for unique individuals and organizations that can be later searched for in the adverse media screening process.

ComplyAdvantage ensures that the database is constantly updated in real-time, providing up-to-date information for searches and ongoing monitoring of existing customers. The ML algorithms read through the media information, identify relevant individuals and organizations, classify adverse media categories, and consolidate this data into comprehensive profiles.

This ML-based approach offers several advantages from a compliance perspective:

Given the benefits of ML, the question arises: Why is now the right time to leverage this technology to solve adverse media challenges?

Two key factors contribute to the urgency.

The convergence of these factors emphasizes the magnitude of the problem at hand. Nevertheless, technological advancements have provided the means to tackle these challenges effectively.

See how 1000+ leading companies are screening against the world's only real-time risk database of people and businesses.

Demo RequestOriginally published 19 September 2023, updated 08 February 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).