Unlock the Power of Comprehensive Due Diligence with KYB by ComplyAdvantage

Move away from siloed compliance processes and combine corporate and risk screening into a single platform to understand who you’re doing business with.

Learn moreAs corporate onboarding frustrations rise in a region where small-to-medium size enterprises make up 99 percent of all businesses, the need for robust Know Your Business (KYB) verification tools has become increasingly crucial for financial institutions (FIs). Several key factors driving the growing demand for KYB solutions include the rise of digital and online transactions that have expanded the scope and complexity of business relationships and the setting up of shell companies to obscure ownership structures.

Since more FIs are dealing with a larger amount of corporate customers – from startups to large-scale organizations – the need to verify their legitimacy and evaluate potential risks has become all the more essential. Globalized markets and increasingly strict regulations compound to amplify corporate customers’ need for comprehensive due diligence. By implementing the right KYB verification tool, firms can strengthen their risk management capabilities, comply with regulatory obligations, and maintain good levels of trust in the integrity of their business relationships.

KYB verification refers to the process firms undertake to confirm the legitimacy of a company before entering into a business relationship with them. Once the business has been onboarded, ongoing KYB verification checks are performed periodically to ensure any changes in the entity’s risk profile are captured. KYB verification checks essentially help firms know who they are doing business with and can help inform the appropriate level of vendor due diligence that should be applied to the customer’s account.

While Know Your Customer (KYC) regulations have been a standard anti-money laundering (AML) obligation globally since the passage of the US Patriot Act in 2001, the regulation did not initially require firms to scrutinize the identity of the businesses they had relationships with. In 2016, the Financial Crimes Enforcement Network (FinCEN) addressed the blindspot by establishing KYB rules in its Customer Due Diligence Requirements for Financial Institutions (the CDD Final Rule). The Final Rule made KYB verification an obligation for financial institutions entering into B2B partnerships or any other business relationship.

Being a critical component of an effective risk management framework, KYB solutions not only protect FIs and their customers, they also help protect the integrity of the financial system. Additional benefits that highlight the importance of KYB screening include:

With KYB by ComplyAdvantage, firms can perform an effective KYB verification check in seven steps.

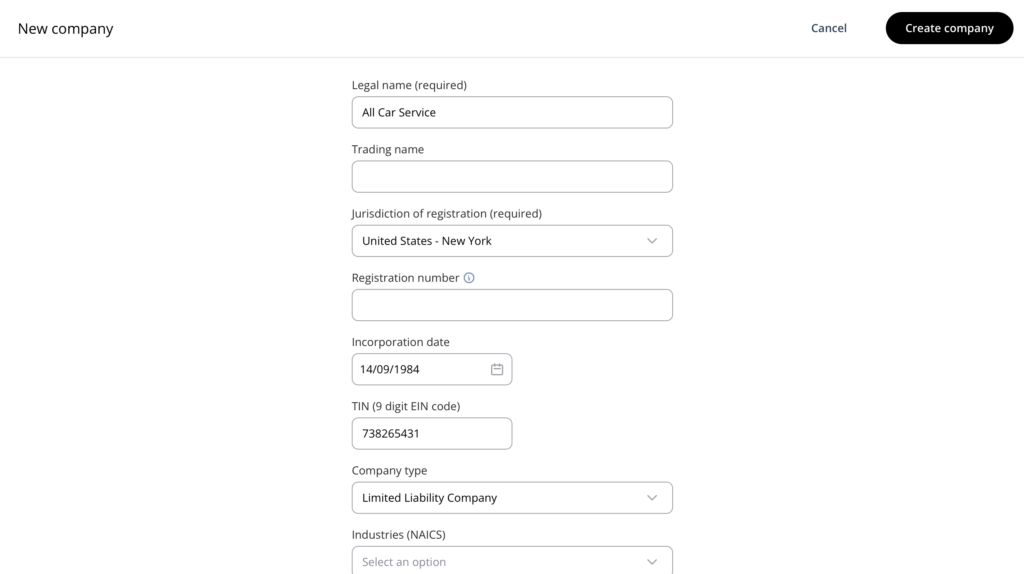

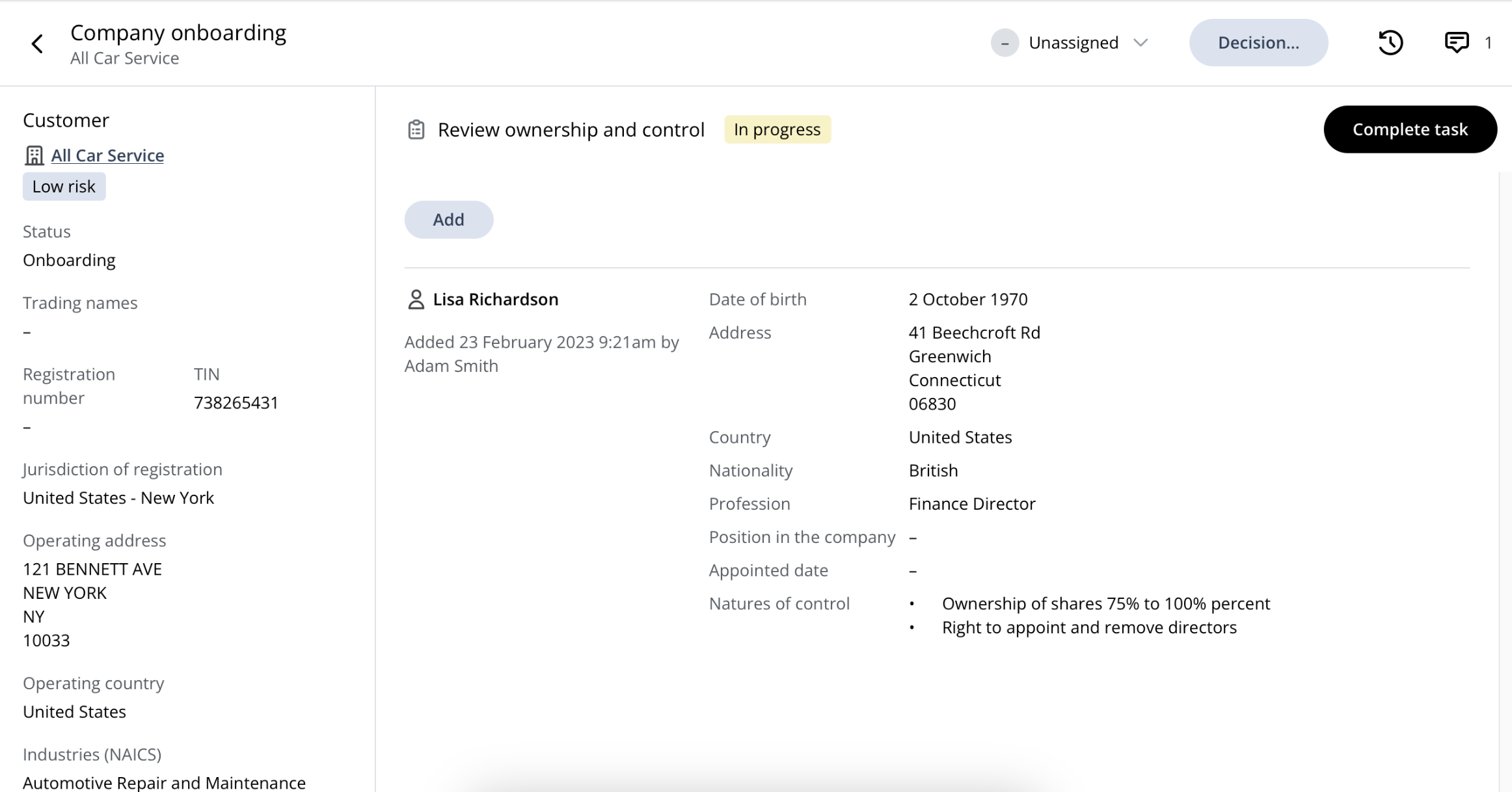

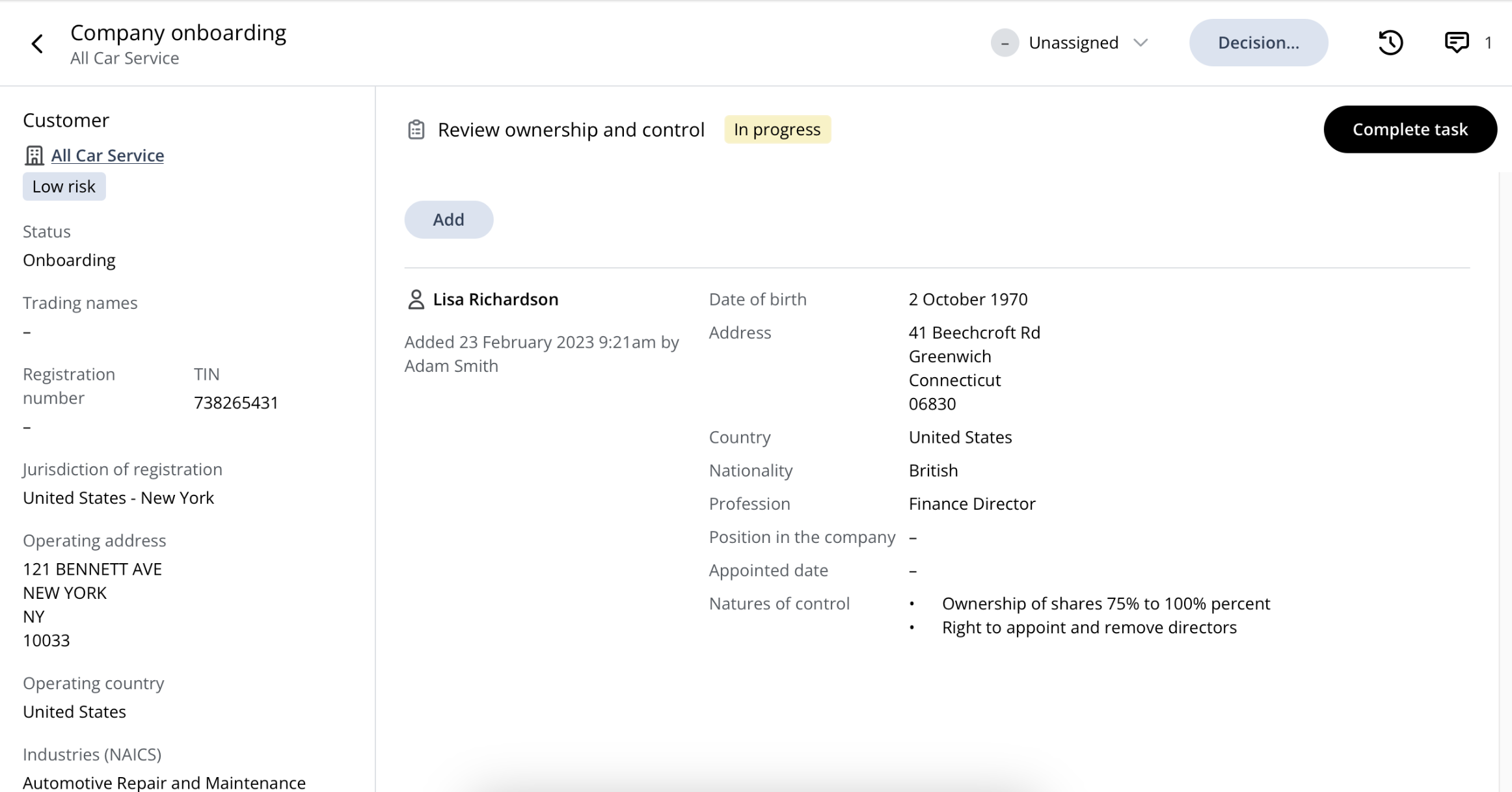

Using API webhooks, firms can create a KYB case using their internal systems. Client-declared company information can be inputted along with additional data uncovered during analyst-led investigations. These details are stored in the firm’s internal systems, eliminating the need for siloed compliance processes and multiple platforms.

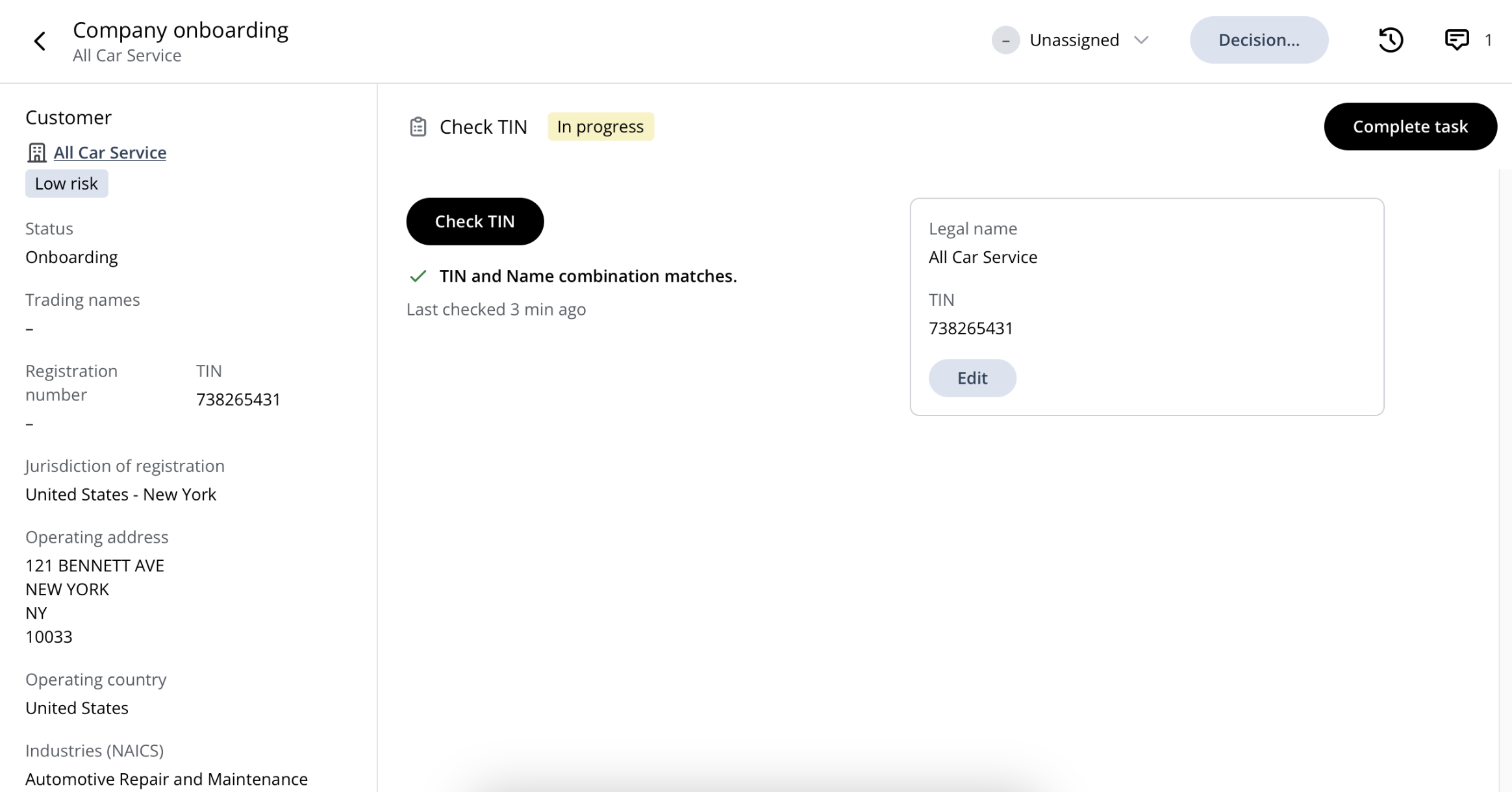

At this stage, compliance staff can ensure the collected company data matches the registry by auto-validating the information collected from their customer. This may include checking that the Taxpayer Identification Number (TIN) matches against the Internal Revenue Service (IRS) register to mitigate the risk of onboarding fraudulent businesses.

Firms can also check for additional risks that may be associated with the business, including:

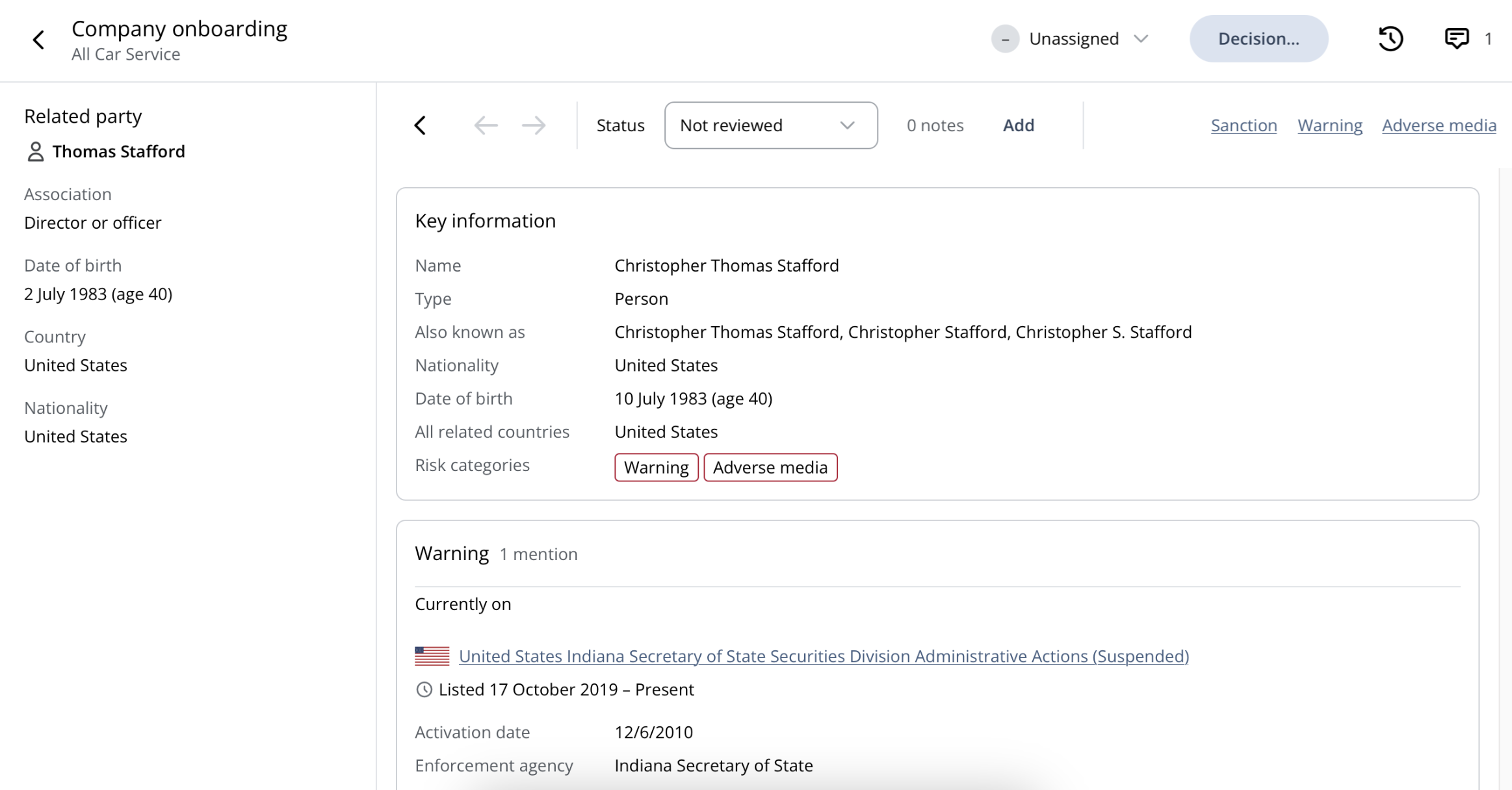

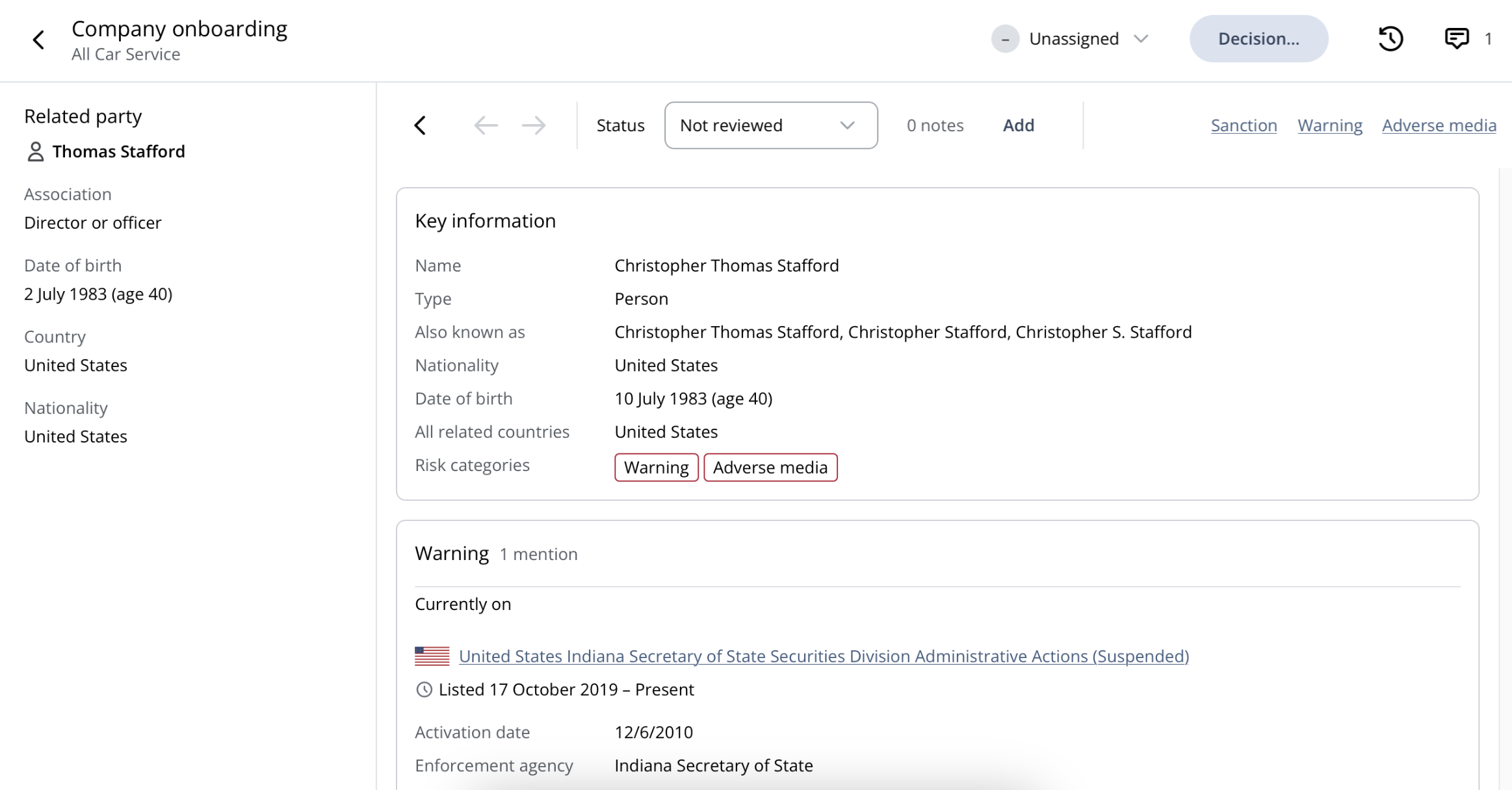

Next, firms can evaluate the accuracy of registry information related to key entities associated with the business. Compliance staff can also create a holistic overview of a case by manually uploading supplementary information about beneficial ownership gathered at the identity verification (IDV) stage.

During the screening process, firms can benefit from the KYB system’s dynamic functionality that updates as the risk of the business changes, alerting compliance staff to review. By applying their own risk formula, firms can ensure the risk scores align with the business’ appetite for AML/CFT threats.

Using the risk score, firms can automate the level of due diligence that should be performed on the business as it is onboarded and on an ongoing basis thereafter.

The business’ risk score will continue to update as the company and its related entities are screened against a real-time global database of sanctions, watchlists, politically exposed persons (PEPs), and adverse media.

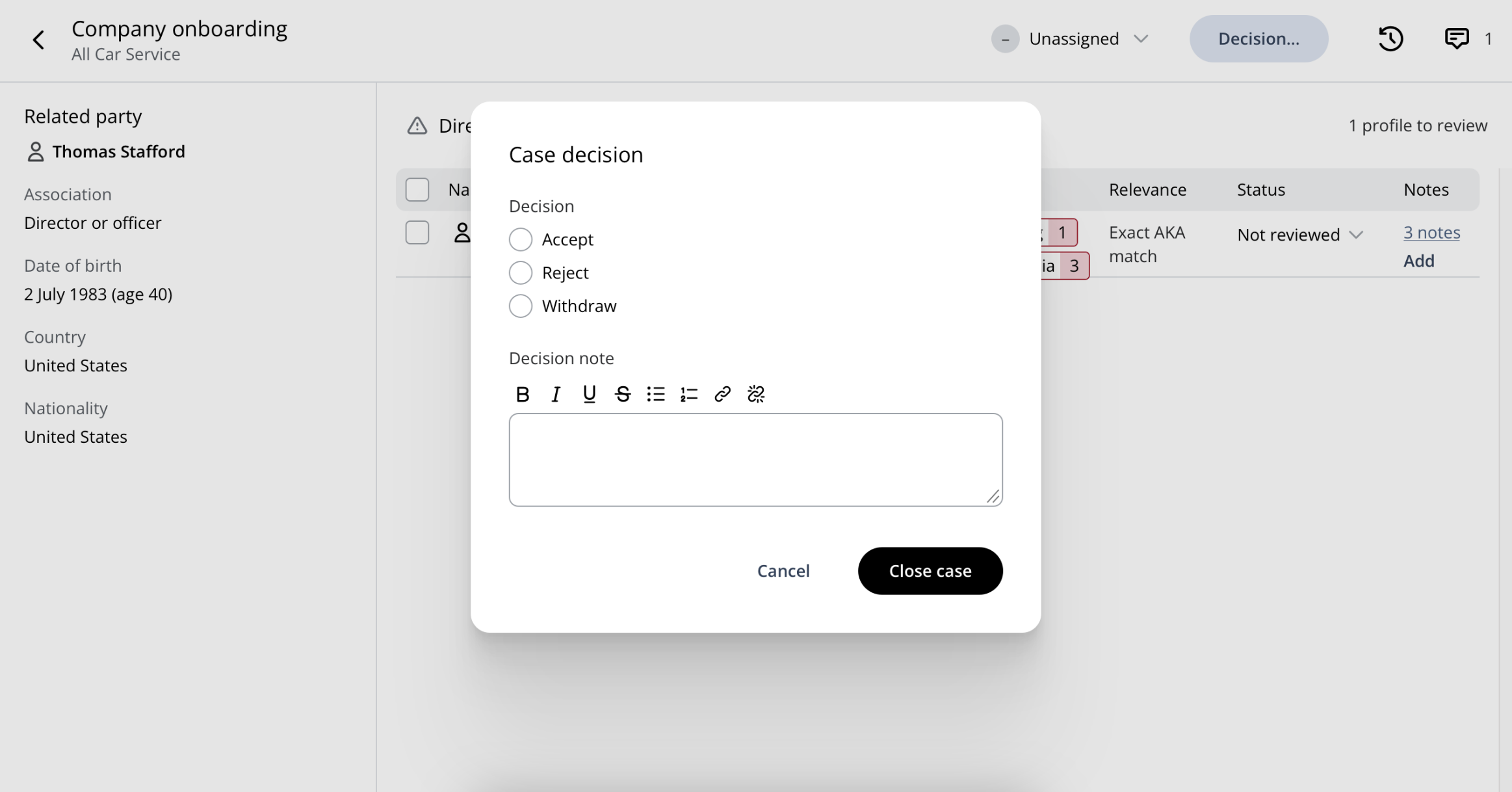

Depending on the level of risk the business poses, compliance staff can now decide to onboard or reject the entity.

Once a customer has been onboarded, they are subject to ongoing monitoring measures, which can be determined automatically in light of the customer’s risk score. If the entity presents a low risk, firms may adopt simplified due diligence (SDD) measures. If a higher risk is presented, firms may perform standard or enhanced due diligence (EDD) measures. With an automated KYB solution, firms can automatically monitor for changes in the customer’s AML risk profile.

To meet the challenge of AML/KYB compliance without negatively affecting the customer experience, firms must seek to deploy a technological solution. Practically, this means automating the collection and analysis of vast amounts of data from a range of sources while building enhanced speed and efficiency into verification measures to reduce administrative friction.

Move away from siloed compliance processes and combine corporate and risk screening into a single platform to understand who you’re doing business with.

Learn moreOriginally published 11 July 2023, updated 06 August 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).