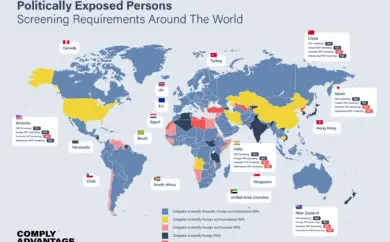

The Challenges of Politically Exposed Persons (PEPs) A Guide to PEPs FATF explicitly emphasizes that its politically exposed persons (PEPs) requirements should not be interpreted in any way as an effort aimed at stigmatizing PEPs. Given the tens of thousands […]