The Challenge of PEPs: A Comprehensive Guide

Take a comprehensive and practical look at the PEP landscape and how firms should navigate it.

Download you copyWhen elected to prominent political positions or assigned high-profile public roles, individuals should be categorized as politically exposed persons (PEPs) to reflect their increased risk of involvement in money laundering or terrorism financing.

Global regulators require financial institutions (FIs) to implement suitable PEP screening measures as part of their anti-money laundering and combatting the financing of terrorism (AML/CFT) programs to determine their customers’ PEP status. While PEP status doesn’t indicate criminal activity or involvement, it does confer important compliance obligations in almost every part of the world due to potential risk.

Firms must be aware of the PEP regulations applicable within their jurisdiction and implement the relevant AML/CFT measures at onboarding and ongoing throughout the business relationship.

The Financial Action Task Force (FATF) characterizes a PEP as an individual entrusted with a significant public role. Although specifics vary across jurisdictions, regulators generally categorize PEPs into three groups:

It’s also worth noting that screening for PEPs extends to their relatives and close associates (RCAs), acknowledging the potential money laundering risks associated with these connections.

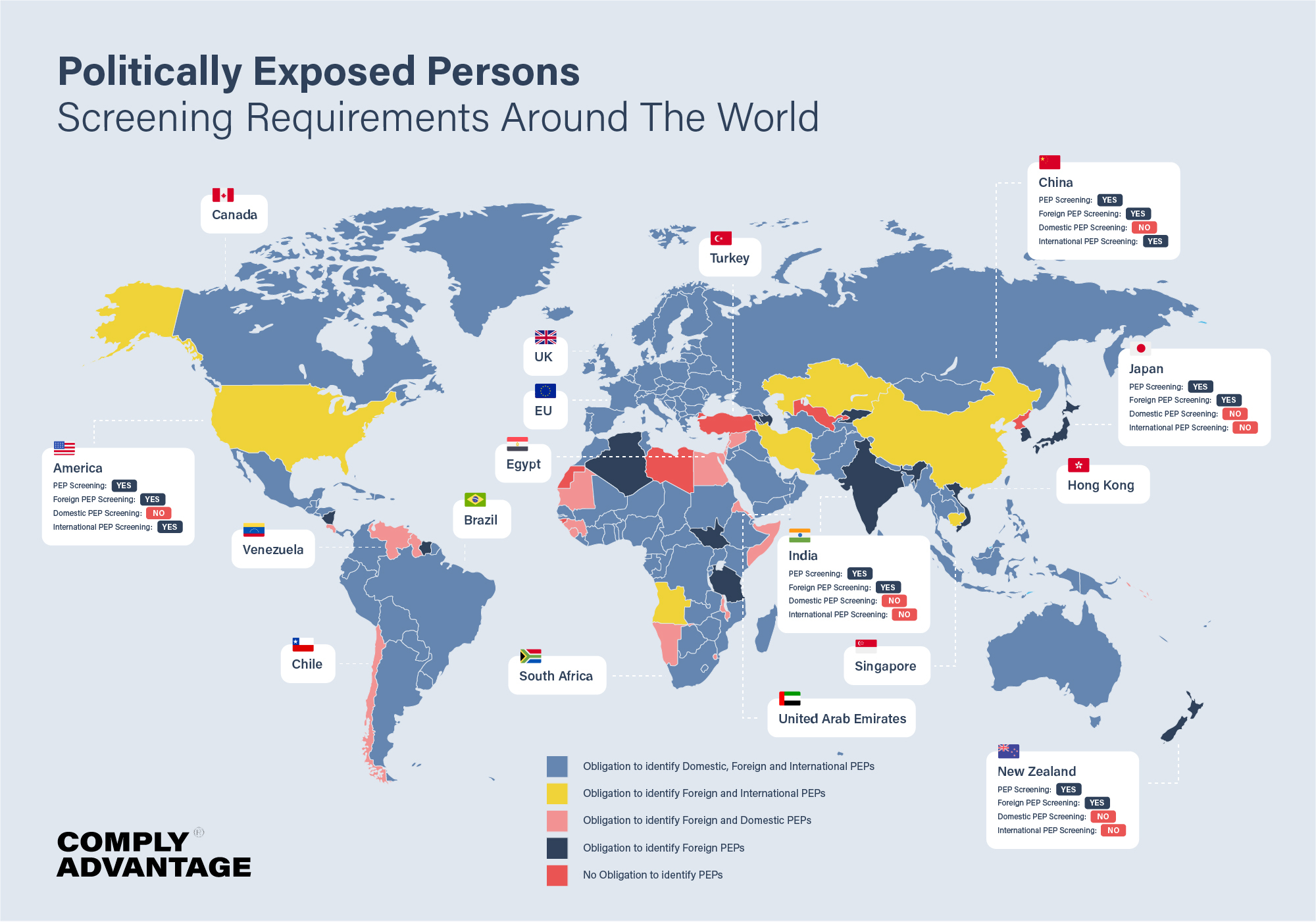

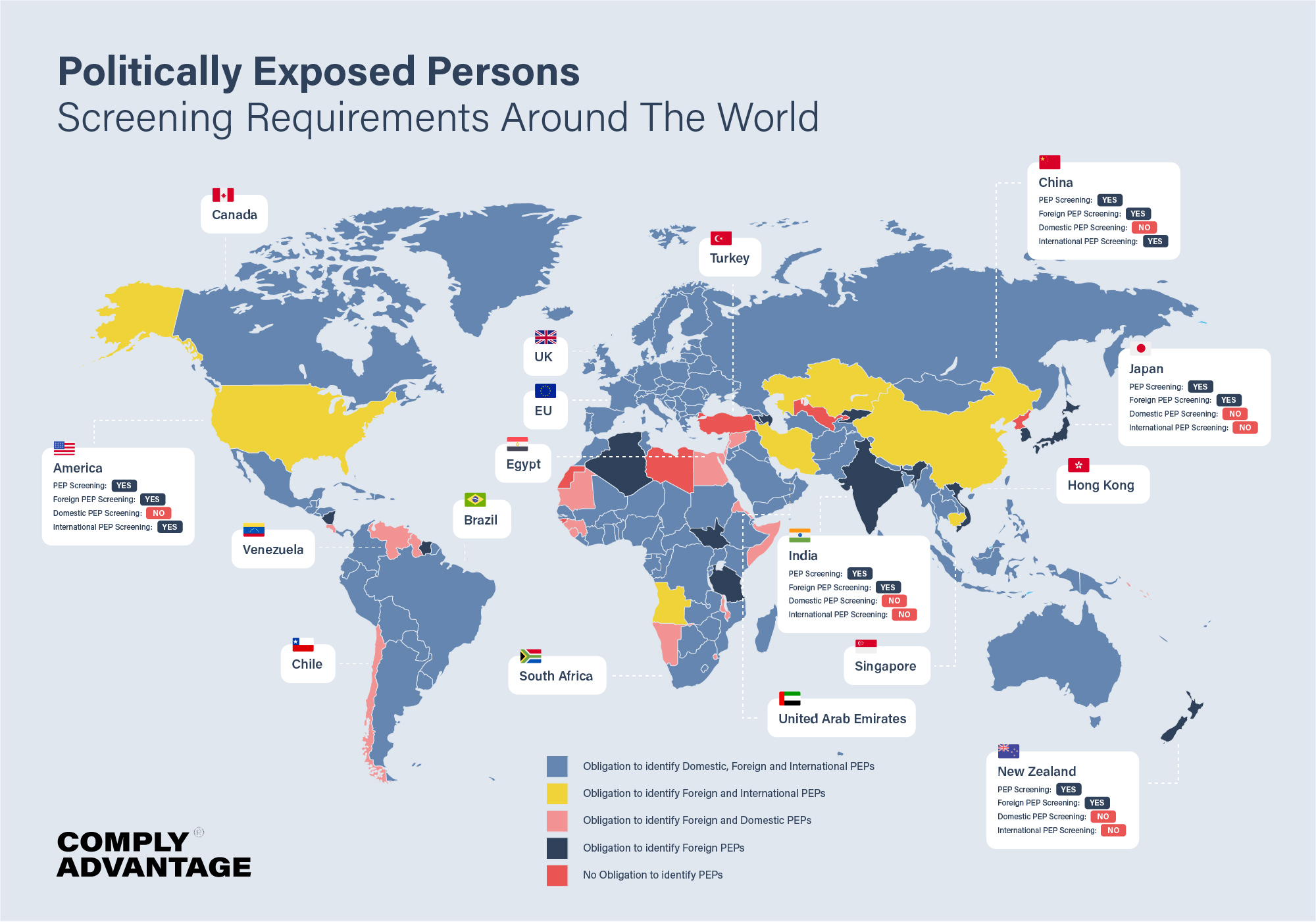

In addition to no one-size-fits-all definition of a PEP, screening requirements for PEPs also need worldwide standardization. Compliance professionals must be aware of this lack of consistency, as every jurisdiction has its own set of rules and regulations that may impact a firm’s PEP risk management practices. In this article, we will explore the PEP requirements in 22 countries:

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: Yes

Using the term “foreign official” to refer to PEP-status individuals, the United States’ PEP regulations are set out in the Bank Secrecy Act (BSA) and the Patriot Act and implemented by the Financial Crimes Enforcement Network (FinCEN).

PEP screening in the United States should be part of a firm’s risk-based AML/CFT program. This means that firms must use reasonable judgment to integrate the appropriate screening processes, including customer due diligence (CDD) measures and enhanced due diligence (EDD) for higher-risk PEPs. When a firm detects or suspects that a PEP may be engaged in money laundering activities, it should submit a suspicious activity report (SAR) to FinCEN.

In 2020, FinCEN and the federal banking regulators put together a joint statement addressing the due diligence banks should follow under the BSA when dealing with PEPs. While it didn’t change how PEPs are regulated, it clarified their obligations under the CDD Rule.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

Following FATF recommendations for implementing AML/CFT regulations, PEP screening in Canada is essential to a risk-based AML/CFT program. Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) sets out specific requirements for domestic PEP screening. While foreign PEPs are always considered high-risk in Canada, the risk presented by domestic PEPs should be determined during onboarding and monitored continuously. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) enforces PEP screening regulations in Canada.

In June 2021, Canada announced that all its entity sectors will have PEP requirements under the PCMLTFA.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

Companies in Latin America must conduct PEP screening, which involves performing risk-based CDD and EDD during the onboarding stage and periodically throughout business relationships.

Mexico follows the standardized AML/CFT legislation established by the FATF for the Latin American region (GAFILAT).

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

Brazil requires PEP screening for all three categories of PEP. In 2019, the Council for Financial Activities Control (COAF), under the authority of the Central Bank of Brazil, expanded the definition of PEP to mayors from all cities, along with councilors, state representatives, and other officials.

In its December 2023 mutual evaluation report (MER) on Brazil, the FATF acknowledged progress in areas such as more substantial supervision of the financial sector. However, the evaluation also highlighted that significant FIs still face difficulties in complying with requirements related to beneficial ownership (BO) and PEPs. As a result, de-risking is often the preferred approach. In light of this, the FATF recommended that Brazil focus on conducting outreach to the financial sector and its associations to correct any misconceptions surrounding these regulations, emphasizing the adverse effects of de-risking.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: No

Chile requires PEP screening AML procedures for foreign and domestic PEPs but not international PEPs. PEP screening in Chile is mandated by the Anti-Money Laundering Act, under the authority of the Comisión para el Mercado Financiero (CMF) and the Unidad de Análisis Financiero (UAF). It requires firms to perform EDD when dealing with PEP-status customers. While it has experienced public and governmental corruption incidents, Chile is not considered high-risk by organizations such as the FATF or the EU.

Take a comprehensive and practical look at the PEP landscape and how firms should navigate it.

Download you copyObligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

The European Union implements a uniform PEP screening policy across its member states through its periodic Anti-Money Laundering Directives (AMLDs). In contrast, non-EU states tend to align their PEP policies with the bloc. Accordingly, PEPs in Germany are subject to the same screening regulations as in France, Spain, and other EU or European Economic Area (EEA) countries.

The EU implements PEP screening as part of a risk-based approach to AML/CFT, and the EU follows FATF in its definition of a PEP and RCA.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

As an EU member state, Germany implements the EU’s AMLDs as part of the continent-wide risk-based approach to AML/CFT. In Germany, PEP screening requirements are enforced by the Federal Financial Supervisory Authority (BaFin) and set out in the Money Laundering Act.

Firms should watch the resources available on BaFin’s official website for all the latest changes and information.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

France mandates its PEP screening in line with EU AMLDs, transposing into the French Criminal Code, the Monetary and Financial Code, and other articles of financial legislation. The Autorite des Marches Financiers (AMF) and the French Prudential Supervision and Resolution Authority (ACPR) primarily enforce PEP regulations.

In March 2023, France revised its definition of politically exposed persons (PEPs) through amendments to the Law on Transparency. The changes on March 17, 2023, specifically impacted the list of national functions, influencing the scope of individuals considered PEPs. Notably, the adjustments included an increase in the annual revenue cap from €10 million to €50 million for state-owned enterprises (SOEs), signaling a lowered risk perception by French regulators and a willingness to extend trust to local businesses with state involvement.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

While the UK is no longer part of the Europen Union, its PEP screening requirements remain broadly similar thanks to the prior implementation of EU AMLDs. The Financial Conduct Authority (FCA) sets out PEP screening requirements in the UK.

In 2023, the FCA announced it was conducting a review into the treatment of PEPs by banks and other financial services firms. The review will consider the definition of PEPs as individuals, the necessary risk assessments, and how firms should communicate with their PEP clients. The report will be ready by the end of June 2024 and available to read on the FCA’s official website.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

Albania proactively employs PEP screening for domestic and international individuals despite not being bound by EU AMLD requirements due to its non-EU status.

This commitment and notable progress in prosecuting money laundering, particularly foreign-sourced proceeds laundered within Albania, led to its removal from the FATF’s grey list in October 2023. Notably, the number of prosecuted money laundering cases has significantly increased, demonstrating Albania’s efforts to strengthen its AML/CFT regime.

More than 40 countries will hold elections in 2024. This will make the PEP environment even more complex and pressure firms’ AML programs, as allegations of corruption could emerge as part of political posturing. Download the report to see how firms plan to respond to this year of uncertainty.

Download your copyObligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Egypt is a member of the Middle East and North Africa Financial Action Task Force (MENAFATF) and has committed to implementing the FATF’s AML/CFT recommendations. PEP screening in Egypt is required for foreign PEPs, while domestic and international PEP screening is not required.

Egypt has previously struggled with money laundering and terrorism financing threats. Still, MENAFATF points out that it has since worked to put appropriate CDD/EDD and monitoring measures under the authority of the Egyptian Financial Regulatory Authority (FRA), which was introduced in 2009.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

In its 2009 evaluation, the FATF identified drug crime and institutional corruption as a problem for South Africa but acknowledged that authorities were working to improve its AML/CFT framework. At

that time, there were also no PEP screening requirements in the country. Under the authority of the South African Financial Intelligence Centre (FIC), South Africa has brought its PEP regulations in line with FATF standards. It now requires PEP screening for all foreign, domestic, and international PEPs.

In 2023, the FATF grey-listed South Africa due to weaknesses in its legal procedures. While not identified as a major deficiency, a previous report in 2021 noted there was a lack of EDD when it came to handling PEPs.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

Saudi Arabia requires PEP screening for foreign, domestic, and international PEPs – setting out its PEP regulations in line with the Anti-Money Laundering Law under the authority of the Saudi Arabian Monetary Authority (SAMA). In 2018, MENAFAFT and FAFT assessed Saudi Arabia’s AML and CFT system, finding that while it was progressing in fighting terrorist financing, it needed to focus more on money laundering on a larger scale.

During a previous evaluation in 2017, the FAFT noted that Saudi Arabia needs a complete definition of what constitutes a PEP and that there are deficiencies in its PEP screening requirements for certain financial services firms. Saudi Arabia has since taken measures to address this and has been found compliant.

Obligation for PEP screening: No

Obligation for foreign PEP screening: No

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Turkey is a part of Asia and Europe and has no screening requirements for foreign, domestic, or international PEPs, diverging from most European countries. Turkey has previously initiated the EU membership application process, but its progress towards full membership has stalled and remains outside the EU and the EEA.

Turkey has adapted its AML legislation to converge with the EU’s Fourth Anti-Money Laundering Directive. It has set out its PEP regulations in the Prevention of Laundering the Proceeds of Crime Act and enforced them by the Banking Regulation and Supervision Agency (BRSA).

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: Yes

The FATF placed Iran on its AML blacklist in 2020 due to specific deficiencies in its AML/CFT framework and ongoing concerns that the country provides support for international terrorist organizations.

PEP screening in Iran is required for foreign and international PEPs but not for domestic PEPs, while PEP regulations are overseen by the Central Bank of Iran (CBI). Iran is currently subject to numerous financial sanctions, prohibiting most firms from establishing business relationships with Iranian persons.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: Yes

China has introduced PEP screening requirements as part of its AML/CFT regulatory framework, overseen by the People’s Bank of China (PBC). This currently applies to foreign and international PEPs but not domestic PEPs. FATF points out that the lack of domestic PEP screening is a significant vulnerability given that corruption is a considerable predicate offense in China and that state-owned organizations play an important economic role.

While screening for PEPs is crucial to a financial institution’s AML program, it’s incredibly challenging to get it right. Take our quiz to test your knowledge.

Take the quizObligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

As a global leader in financial services, Singapore requires PEP screening for foreign, domestic, and international PEPs under AML/CFT regulations enforced by the Monetary Authority of Singapore (MAS).

In Singapore’s last MER – conducted in 2016 – the FATF explored the issue of CDD, specifically in relation to PEPs, identification of the source of funds, ongoing transaction monitoring, and identification of beneficial ownership. The FATF assessed the extent to which private banks and asset management firms in Singapore were effectively complying with their existing AML/CFT obligations. The assessment concluded the country to be mostly compliant in this regard but recommended pursuing more foreign PEPs involved in laundering corrupt proceeds and their professional enablers.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Over the past few decades, Korea has significantly strengthened its AML/CFT regulations to address PEP-related money laundering – enforced by the Korea Financial Intelligence Unit (KoFIU).

However, PEP screening in South Korea is still a significant AML consideration as, in 2020, the FATF highlighted that more needs to be done to stop government and public officials from laundering the proceeds of corruption.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Japan has traditionally resisted imposing increased PEP screening requirements. Still, a new focus on anti-bribery and anti-corruption by the Financial Services Agency (FSA) has prompted tighter AML/CFT restrictions.

In Japan, foreign PEP transactions are now automatically classified as high-risk and must be subject to EDD measures.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Firms are required to screen only foreign PEPs in India. As an observing member of the FATF, India is working towards full membership, which means it implements a risk-based approach to AML/CFT. Accordingly, firms should put EDD measures in place to detect PEP-status customers.

PEP regulations in India are set out by the Prevention of Money Laundering Act 2002 and enforced by the Reserve Bank of India (RBI).

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

The Australian Transaction Reports and Analysis Centre (AUSTRAC) is the regulatory body responsible for enforcing and overseeing AML/CTF in Australia. AUSTRAC sets the guidelines and methods for conducting CDD, including identifying and screening PEPs.

FIs and other reporting entities in Australia must adhere to these regulations and follow AUSTRAC’s guidelines.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

PEP screening in New Zealand only applies to foreign PEPs; however, New Zealand is a member of the FATF, so its AML/CFT regulations require firms to implement risk-based measures and take reasonable steps to establish the source of PEPs’ wealth. New Zealand’s PEP regulations are set out in the AML/CFT Act 2009 and enforced by the Reserve Bank of New Zealand (RBNZ).

With many national elections planned in 2024, firms have begun to review their PEP risk management processes. In our annual compliance survey, 61 percent of firms said they expect their organization to become more risk-averse when dealing with PEPs over the next 12 months.

Given this uncertain environment and diverging regulations worldwide, how can firms practically employ effective PEP screening processes?

This article should be used as a guide, not legal advice.

See how leading companies are screening against the world's only real-time risk database of people and businesses.

Request a demoOriginally published 27 May 2020, updated 10 June 2024

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).